Kirin Views is the second series of Kirin Capital towards the goal of “Know Vietnam, Long Vietnam”. This column provides Kirin’s observations and opinions on Vietnamese market through in-depth research driven by an expert team with decades of experience, assisting investors at home and abroad in better understanding the potential opportunities of Vietnam and join hands with “Know Vietnam, Long Vietnam”.

In the previous discussion on Vietnam’s pork industry, Kirin highlighted branded pork as a rising trend. And when it comes to this, it’s hard not to mention HAG and its brand “Heo An Chuoi”. Nonetheless, a lesser-known fact is that this company initially made its fortune from real estate. How did the founder decide to abandon what seemed like a money-making real estate business to start raising pigs? When will this company overcome its challenges and hit a home run? Join us in this episode to find the answers.

01 Going to college is not the only path to success

HAG founder Đoàn Nguyên Đức (often called “bầu” Đức) owned a well-known football team and even personally hired the Korean coach Park Hang-seo, who changed the fate of the Vietnam national football team. His biggest success was once the subject of ridicule, football. This is because Bầu Đức faced numerous setbacks in life, but his persistent and optimistic spirit never let him down. Perhaps this spirit was developed through his experiences.

Bầu Đức was born in a family with nine children in Gia Lai Province, Vietnam, and from a young age, he helped with farming activities at home. After failing the college entrance exam for three years, he finally accepted reality and returned to his hometown to work. After accumulating some capital, he opened a small workshop specializing in making desks and chairs for students. Around 1991, Mr. Đức coincidentally met a Taiwanese expert who was conducting market research on wood in Gia Lai and expressed interest in collaborating with him. The Taiwanese side would provide machinery and technical guidance, while Bầu Đức would be responsible for wood product manufacturing and labor management. This marked the establishment of the precursor to HAG in 1993, engaging in wood processing and export business.

After four years of doing business with Taiwanese entrepreneurs, Bầu Đức had paid off all debts and gained full control over the factory’s mechanical equipment assets. Based on this foundation, starting in 2000, HAG began expanding its production and business activities into other fields, such as granite, latex processing, packaging production, and real estate.

What truly made Bầu Đức the richest person in the Vietnamese stock market in 2008 and 2009 was real estate. According to the company’s annual report, in 2009, HAG generated 75% of its revenue from real estate, with a total of 26 projects and a construction area of up to 2.5 million square meters.

02 Was the decision to transition from real estate to agriculture the right one?

However, the good times didn’t last long, as Vietnam experienced its third real estate bubble burst from 2009 to 2012. Bầu Đức also believed that the real estate industry was too complex and not suitable for him, so he decisively abandoned it. It took two years to make the decision to complete the sale, and the properties were sold for less than half of their market value. In 2012, real estate revenue still accounted for as much as 64.4%, but by 2013, it had dwindled to just 8.9%.

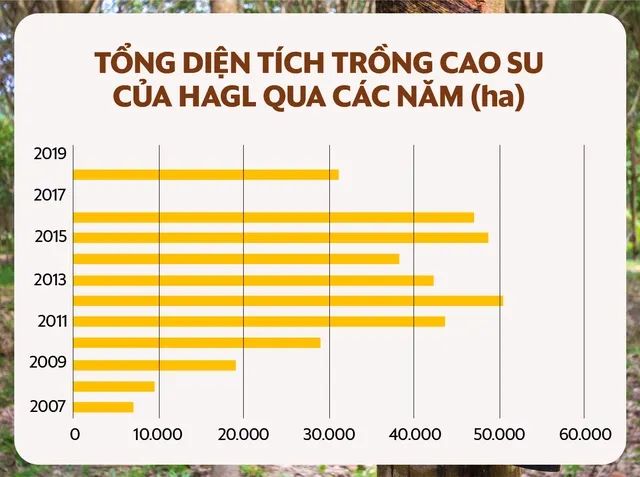

Another reason that gave HAG the confidence to exit the real estate sector was the booming rubber industry at the time. Rubber was referred to as “white gold” because it cost $1300 per ton to produce but was sold for $5000 per ton, offering a much higher return on investment than real estate. Bầu Đức himself had been involved in investment and business in Laos for a long time, so he sold all his land and invested all his money in rubber production in Laos. Additionally, he allocated a small portion of his investments to real estate in Myanmar.

Unfortunately, five years later, when the rubber was ready for harvesting, the price of rubber plummeted from $5000 per ton to less than $1000 per ton. No one anticipated that the drop in rubber prices would be far below expectations, even falling below the production cost. According to Bầu Đức, this became the primary reason for HAG’s liquidity difficulties in the following years.

03 From the richest person to the largest debtor: A decade of transformation

In fact, rubber takes about 5 years to mature, so the price collapse occurred five years later. During the five years leading up to the harvest, project investment funds, company operating costs, not to mention substantial interest expenses (bank loans accounted for over half of the total assets over the years) – where did HAG get the cash flow to cover these expenses?

Bầu Đức and HAG always emphasized a “short-term nurturing for long-term growth” strategy. From 2011 to 2015, they initially “nurtured” rubber through sugarcane and oil palm cultivation. Sugarcane was considered HAG’s “golden goose” before 2014. However, in 2017, pressured by debts exceeding 36 trillion Vietnamese dong, he had to sell the sugarcane business to Thanh Thanh Cong – Bien Hoa JSC (SBT). The oil palm harvesting cycle, while shorter than rubber, still required 30 months.

Starting in 2014, HAGL began transitioning to cattle farming to “rescue” the group from a financial crisis caused by high costs. Cattle could be raised in as little as 18 months, offered high gross profits, and their dung could be used for farming. By 2016, HAGL’s financial crisis had reached its peak, with most of its assets pledged to repay maturing loans. Income from cattle farming accounted for as much as 55% and became the sole support that temporarily helped the company escape the tragedy of collapse.

However, cattle farming couldn’t rescue HAG for long. Every time a cow was sold, the bank would reclaim the debt associated with that cow, and they were unwilling to extend further loans. Consequently, HAG had to abandon cattle farming.

During the six years when banks were unwilling to extend loans, HAG found ways to cultivate various fruit trees, including but not limited to passion fruit, dragon fruit, bananas, avocados, rambutans, coconuts, longans, and seasoning crops like chili and pepper. According to Bầu Đức, he was mocked for this approach, but he believed that if they hadn’t done so, HAG would have struggled to survive at that time.

In addition to providing short-term cash flow to HAG, fruit tree cultivation also introduced Bầu Đức to a new partner, who can be considered HAG’s “savior” – Trường Hải Auto Corporation (THACO) Chairman Trần Bá Dương. On August 8, 2018, THACO and HAG signed a strategic cooperation agreement, including THACO’s investment and ownership of a 35% stake in HAG’s fruit tree subsidiary, HNG. THACO’s real estate subsidiary, Đại Quang Minh, also acquired a 51% (later increased to 65%) stake in HAG’s project in Myanmar.

THACO also provided financial support for HAGL’s debt restructuring and arranged investment funds to implement a sustainable development strategy. The total cost of this transaction exceeded 22 trillion Vietnamese dong (equivalent to nearly 1 billion US dollars). It was also the largest cooperation deal between two domestic companies in the history of the Vietnam Securities Trading Center. Subsequently, THACO and its related parties increased their ownership stake in HNG to 63.08%, while HAG was left with only 26.82%.

THACO became the parent company of HNG and owned 35,000 hectares of land, only half of which could be used for planting after renovation. HAG also shed 100 trillion Vietnamese dong ($4.2 billion) in debt and gradually emerged from bankruptcy crisis by divesting six subsidiaries with a total value of 76 trillion Vietnamese dong ($3.2 billion) in 2019, including rubber and oil palm operations.

04 Finally, there is a ray of hope ahead

Despite selling its subsidiary HNG, HAG’s long-term development strategy remains focused on agriculture. In terms of fruit trees, the company now primarily cultivates bananas and durians, while for livestock, they have chosen to raise pigs.

Regarding the decision to raise pigs, Bầu Đức explained that HAG has an abundant source of bananas that are surplus to export demand (bananas rejected when exporting to Japan, South Korea, and China). These bananas can be used to feed the pigs, making up 40% of the pig feed and saving HAG 30% in costs. HAG has also created a unique pork brand called “Heo Ăn Chuối” and opened many chain stores nationwide called BapiMart. Initially, this brand gained popularity among some people due to its reasonable prices and delicious meat.

HAG’s branded pork chain

However, most of HAG’s pork is still sold to small vendors, making it highly susceptible to fluctuations in live pig prices. Unfortunately, HAG heavily invested in pig farming during a period when live pig prices were entering a downward cycle, dropping from 70,000 Vietnamese dong (20 Chinese yuan) per kilogram in July 2022 to 48,000 Vietnamese dong (15 Chinese yuan) per kilogram by March of this year.

This meant that the company essentially didn’t make any money from pig farming in the first half of this year. Its profits relied entirely on exporting bananas (which saw prices increase from 7.5 USD per box last year to 10.5 USD). After deducting regular interest expenses and facing weak consumer demand, the company couldn’t sustain its pork brand and abruptly closed all its chain stores. Only recently did it start consigning its products to well-known supermarkets like Saigon Co.op in the South.

With the supply side affected by African swine fever, live pig prices started to rise in April and are now maintaining at around 60,000 Vietnamese dong. In the future, the supply side will continue to decrease due to many farmers abandoning pig farming, and HAG expects to see better returns from pig farming once again.

Another new breakthrough for HAG comes from durian. Currently, the company has 1,200 hectares dedicated to durian cultivation, including 300 hectares of the world-famous Musang King variety, and the rest being Thai first-grade Golden Pillow durians. Recently, China’s demand for imported durians from Vietnam has surged, and wholesale prices have sometimes reached 150,000 Vietnamese dong (45 Chinese yuan) per kilogram. Will this be similar to the rubber disaster?

Bầu Đức is confident and denies any similarities, as durian cultivation started four years ago, and this year, the company can harvest its first batch of approximately 500 tons, which are being purchased by small vendors at around 77,000 Vietnamese dong, with a cost of only 14,000 Vietnamese dong per kilogram.

After a tumultuous journey of three decades, the dream of HAG’s leader is no longer to be Vietnam’s richest person. Now, he simply hopes to clear all the debts by 2025 and build HAG into a solid company while taking care of the lives of those who have followed him for decades. Fortunately, it seems that the road ahead is a bit smoother now.

Kirin Capital is a research-driven equity investment company headquartered in Hanoi, Vietnam. Its core members have more than 20 years of financial experience in China and more than 10 years of financial and industrial investment experience in Vietnam. The investment covers TMT, large consumption, manufacturing, health care and financial services, and other fields, and spans all stages of equity investment such as seed investment, venture capital, private equity investment, listed company investment, and M&A investment.

Our vision is “Know Vietnam, Long Vietnam”. Through rich financial experience and local resources, we will be a guide for investors at home and abroad to invest in Vietnam and share Vietnam’s rapid growth development dividends.

If you have any needs related to the Vietnam market or would like to participate in our Kirin Views program and share your insights into the local market, please feel free to contact us HERE