Kirin Views is the second series of Kirin Capital towards the goal of “Know Vietnam, Long Vietnam”. This column provides Kirin’s observations and opinions on Vietnamese market through in-depth research driven by an expert team with decades of experience, assisting investors at home and abroad in better understanding the potential opportunities of Vietnam and join hands with “Know Vietnam, Long Vietnam”.

Vietnam, which belongs to the Confucian cultural circle, also has a strong preference for pork. Whether it’s the fried sausages and fried sour meat sold on the streets, or the pork dumplings and braised pork ears served during festivals, pork is ubiquitous in Vietnam’s daily life.

So, how much pork do Vietnamese people consume, what are their consumption habits, and which meat product companies represent the local market? These questions will be answered in this article.

01 Demand side: The scale and growth rate of Vietnam’s pork market

In terms of proportion, Vietnamese consumers’ daily diet consists of 70-75% pork, 20-25% poultry, and only 5-10% of other meats such as beef [1]. In comparison, in 2021, pork, poultry, and beef consumption in China accounted for approximately 59%, 26%, and 10%, respectively.

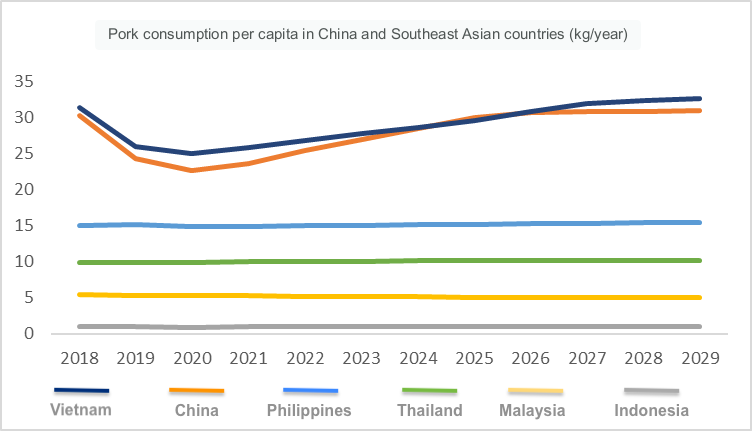

In terms of consumption volume, in 2022, Vietnam ranked first in Southeast Asia with a consumption of 3.45 million tons of pork, followed by the Philippines (2.17 million tons) and Thailand (0.9 million tons). Moreover, in terms of per capita pork consumption, Vietnam even surpasses China. In 2022, the annual per capita pork consumption in China is about 24 kilograms, while in Vietnam, it is 26 kilograms (the blue line represents Vietnam, and the orange line represents China) [2]:

In terms of types, there are currently three main types of pork in the Vietnamese market: hot fresh meat, cold fresh meat, and frozen meat.

Hot fresh meat refers to meat that is transported to the market immediately after being slaughtered at the abattoir, without being refrigerated or frozen. Although there are some hygiene risks, the price is cheap, and the market share is currently close to 95%; for example, the price of pork belly is about 57,000 VND/kg.

Cold fresh meat is processed at 0-4℃ and acidified, which is hygienic and nutritious, but the price is correspondingly higher, with pork belly costing about 75,000 VND/kg. Therefore, the market acceptance is relatively low.

Frozen meat is meat that has been frozen at -18℃, with the poorest quality and nutrition, but also the cheapest, with pork belly costing about 48,000 VND/kg. It is mainly sold to restaurants or food processing companies.

Although the compound annual growth rate of pork consumption in Vietnam from 2018 to 2022 was -3% due to the rising prices caused by African swine fever and the decrease in income of workers caused by the three-year pandemic, based on Vietnam’s pork consumption tradition and economic recovery after the pandemic, the OECD still expects the compound annual growth rate of pork consumption in Vietnam to reach 4% from 2023 to 2028.

02 Supply side: Four major players in Vietnam’s pork market

Vietnam’s pig farming industry is also experiencing a similar trend of centralization in China. From 2011 to 2020, the number of pig farms nationwide decreased from 4.13 million to about 2 million.

However, currently, small-scale farmers (with less than 10 pigs) still dominate the participants in Vietnam’s pork industry. In 2021, small-scale farms accounted for 58.4% of all farms in the country, while the top 16 large-scale farms (with over 1,500 pigs) accounted for 20.7% of the total.

Among these top 16 large-scale farms, the most representative “four big players” are CP Foods VN, Dabaco, Masan Meat Life, and Vissan.

CP Foods is the leading enterprise in Vietnam’s pork food industry, with a market share of 18% in 2022. CP Foods VN is actually the Vietnamese subsidiary of CP Foods, Thailand’s largest agriculture and food conglomerate, which was first established as an office in 1988. In 2022, CP Foods’ revenue reached VND 85.1 trillion, with an average annual growth of 20% over the past three years.

To smooth out the impact of rising feed prices on profits, CP Foods VN has been continuously expanding its industrial chain upstream and downstream, the so-called 3F model (Feed-Farm-Food), which is also the common practice of the “four big players.”

For CP Foods VN, in the Feed aspect, the company owns 10 feed factories. In the Farm aspect, it adopts a model of cooperation with farmers, selling breeding pigs, feed, veterinary drugs, and providing technical support to farmers, and also responsible for the marketing of the products. In the Food aspect, there are five slaughter and processing plants, and the company has established several downstream brands, including CP, CP Fresh Mart/Shop, and CP Five Star.

Among them, CP is the brand for meat products, with a wide range of categories, including fresh meat, ham sausage, canned food, Vietnamese dishes, buns, etc., not only pork but also poultry and seafood. CP Fresh Mart/Shop is the company’s retail chain with a total of 67 stores nationwide, while CP Five Star is the company’s fast-food chain that sells fried chicken and fried ham sausages, among other fried skewers.

Ranked second is Dabaco, established in 1996 with Vietnamese capital for 94.24% of the shares. In 2022, its revenue in the feed farming and food processing sectors was VND 1.13 trillion, with a compound annual growth rate of 18% in the past three years.

In terms of feed, the company has 7 subsidiary pig breeding companies and 6 pig feed production companies; in farming, it has 8 farms with an annual output of 1 million pigs; and in food, third-party slaughter and processing are conducted under company supervision. As for downstream branding, Dabaco only has meat products with low customer recognition, and the majority of its pork is sold to small vendors.

The third rank is Masan Meat Life, which was founded in 2011 and is a subsidiary of Masan Group, the largest retail company in Vietnam by market value. In 2022, its revenue was VND 480 billion, a 75% YoY decrease from 2021, as Masan Meat Life sold its feed business to De Heus, one of the top 15 global feed companies.

Why sell the feed business? On one hand, Masan Meat Life wanted to concentrate on producing fresh meat, and on the other hand, De Heus became Vietnam’s largest feed enterprise after the sale, and Masan can negotiate feed prices with them – still deepening the logic of upstream supply chain management.

Therefore, in terms of Feed, Masan Meat Life mainly cooperates with De Heus; in terms of Farms, it has one farm with an annual production of 250,000 pigs; in terms of Food, it has two slaughter and processing plants. Its downstream brand Meat Deli focuses on fresh meat and is popular among the middle class. The main sales channels are Meat Deli’s own chain stores, as well as Winmart supermarkets, which are also under the Masan Group.

Ranked fourth is Vissan, founded in 1970, with Vietnamese capital accounting for 95.72%, of which Masan Meat Life holds 24.94%. In 2022, its revenue was 3.8 trillion Vietnamese dongs, but its growth has been negative for the past two years, with declines of more than 10%.

The official explanation is a decrease in consumer demand, but looking at it from upstream and downstream perspectives, Vissan has not laid out in the upstream feed sector. Although it uses a model of cooperation with farmers for Farms, its own pigs only account for 10% of the meat product input, and the other 90% needs to be purchased from related companies. This shows that Vissan has the weakest control over the upstream sector, which may partially explain its negative growth.

In terms of Food, Vissan has an industrial park and a slaughter and processing plant. Its downstream brand Vissan specializes in ham sausage and canned food, which can be understood as the Vietnamese version of “Shuanghui.” Its own retail stores are concentrated in the south, and its products are also sold in major supermarkets such as Co.op Mart, BigC, and Lotte Mart nationwide.

03 Envisioning the Future: What to Expect

For the future development of the Vietnamese pork industry, we believe there are three major trends.

First, the rise of ready-to-eat foods. Young people living in big cities tend to purchase ready-to-eat foods, including meat products, due to their busy work schedules. Rolled meat and ham sausages are the most popular food items for young people to prepare as offerings for worship and are also loved by many children. According to Statista, revenue from ready-to-eat meat products in Vietnam is expected to reach USD 1.12 billion by 2023, with a compound annual growth rate of 5.50% from 2023 to 2027, which is higher than the growth rate of pork consumption.

Second, Vietnamese consumers’ awareness of nutrition and health is increasing, and channel changes are causing the consumption scene of pork to shift from traditional markets to convenience stores or supermarkets, thus increasing consumers’ demand for branded pork. According to Ipsos Vietnam, the market share of branded pork in Vietnam is currently only around 10%, leaving room for an annual growth rate of about 10% to 15%.

In the past two years, new brands such as “Banana-fed pig” (HAG) and “Vegetarian pig” (BAF) have also emerged in Vietnam. These brands are priced similarly to fresh pork (around 75,000 VND per kilogram) and are more popular among consumers. HAG’s pig farming revenue in 2022 was triple that of the previous year, and BAF’s revenue also increased by 73% year-on-year in 2022. However, products with organic pork concepts are relatively expensive (170,000 – 190,000 VND per kilogram), and the customer base is limited to the middle and upper classes with strong consumption power.

Third, the consumption of chicken will increase. Because chicken is relatively affordable (pork is about CNY 65,000 – 75,000 per kilogram, while chicken is about CNY 45,000 – 50,000 VND per kilogram) and its protein content is comparable to that of pork, some consumers choose to replace pork with chicken as red meat. Of course, the Vietnamese people’s preference for pork is difficult to change in the short term, and pork remains the preferred choice for most Vietnamese families’ three meals a day.

*Reference materials:

[1] “Despite Expensive Pork, Vietnamese Still Love to Eat It,” Ho Chi Minh City Law Newspaper, 2019

[2] “Agricultural Outlook,” OECD and FAO, 2021

[3] Financial reports of HAG and BAF companies, 2023.

Kirin Capital is a research-driven equity investment company headquartered in Hanoi, Vietnam. Its core members have more than 20 years of financial experience in China and more than 10 years of financial and industrial investment experience in Vietnam. The investment covers TMT, large consumption, manufacturing, health care and financial services, and other fields, and spans all stages of equity investment such as seed investment, venture capital, private equity investment, listed company investment, and M&A investment.

Our vision is “Know Vietnam, Long Vietnam”. Through rich financial experience and local resources, we will be a guide for investors at home and abroad to invest in Vietnam and share Vietnam’s rapid growth development dividends.

If you have any needs related to the Vietnam market or would like to participate in our Kirin Views program and share your insights into the local market, please feel free to contact us HERE