Kirin Views is the second series of Kirin Capital towards the goal of “Know Vietnam, Long Vietnam”. This column provides Kirin’s observations and opinions on Vietnamese market through in-depth research driven by an expert team with decades of experience, assisting investors at home and abroad in better understanding the potential opportunities of Vietnam and join hands with “Know Vietnam, Long Vietnam”.

As of the first half of 2023, South Korea is currently the largest investor in Vietnam, with a total capital of up to 82 billion USD. Before shifting its focus to high-tech projects such as Samsung Bac Ninh, Samsung Thai Nguyen, Samsung Ho Chi Minh City, and LG Hai Phong, South Korea was a major investor in the textile industry.

In this Kirin Views, we will explore TCM (Thanh Cong Textile Garment Investment Trading Joint Stock Company), one of the prominent textile enterprises with 44.96% South Korean ownership, as well as the overall landscape of Vietnam’s textile industry, in which ESG is the key point.

01 A pioneer in Vietnam’s textile industry

TCM, originally a private textile enterprise with 500 employees, operated primarily in the weaving and dyeing sectors. The company’s products were mainly consumed in two major markets: the southern region of Vietnam and the Cambodian market.

In 1992, TCM established its first yarn factory. Subsequently, they started producing garments, handling the entire process from upstream to downstream, but the upstream could only supply part of the materials. Up to now, TCM meets about 35% of its yarn and 85% of fabric demands, which is already a rare proportion in the industry.

In the mid-1990s, TCM’s collared t-shirts were the best-selling products in the market. However, as the economy developed, Vietnamese consumers shifted their preferences from “durable and functional” to “stylish and attractive” clothing. TCM’s products lacked diversity in design and materials, while other companies were competing by producing t-shirts with various colors and price ranges, leading to a loss of customers for TCM.

Recognizing these limitations, TCM made efforts to build its own brand in the fashion industry.

Ms. Bui Thanh Thuy, a designer at Fadin Fashion Institute in Vietnam, who participated in designing and promoting TCM’s brand at that time, candidly shared: “TCM had significant opportunities, but perhaps investing in building its own brand required substantial costs and a long-term perspective to see results, unlike product manufacturing and processing where results can be seen immediately, so they did not continue the investment.”

Regarding the quality of the clothing, according to Ms. Thuy, TCM had almost all the equipment to produce the best spandex fabric at that time but lacked the technology to ensure the products maintained their shape over time, resulting in an inability to sell at higher prices.

It can be said that TCM recognized early on the importance of penetrating the supply chain and invested 4 million USD in purchasing the most advanced equipment. However, due to various factors, the results did not meet expectations.

02 TCM after receiving investment from South Korean E-Land

Realizing the need for experienced investors’ involvement, TCM transformed into a joint-stock company in 2006 and went public in 2007. At the same time, TCM raised capital from E-Land Asia Holdings (a subsidiary of E-Land, one of South Korea’s largest fashion and retail conglomerates), inviting them to become TCM’s shareholders and participate in the company’s strategic planning. Thus, what values did E-Land’s participation bring to TCM?

First and foremost, it was evident in the increased number of orders.

In the yarn sector, E-Land brought in significant contracts from foreign countries for TCM. In the knitting sector, E-Land developed new customer sources in South Korea and improved product quality. In the garment sector, E-Land successfully unlocked the Chinese and South Korean export markets for TCM.

In the early stages, 50% of TCM’s orders were secured through E-Land. However, the dependency decreased with the participation of multiple new markets, and by 2022, only about 20% of TCM’s orders belonged to E-Land.

In terms of management, E-Land appointed Mr. Lee Eun-hong as the first Korean CEO and restructured the export business department by market (USA, Japan, EU, South Korea, etc.), recruiting experienced foreign experts. The company also gradually implemented an ERP system to tightly manage the order distribution process, from raw material input to finished products.

In terms of research and innovation, E-Land led TCM to sign a technical cooperation agreement with Hyosung Group – one of the seven largest conglomerates in South Korea in 2013, to enhance the company’s research and development capabilities. In 2015, TCM established the Research and Development Center, collaborating with the Korean Textile Research and Testing Institute (KOTITI Global) to inspect the quality of output products.

Currently, the company focuses on developing three main product lines: Environment-friendly products (including recycled polyester fibers from plastic bottles, sugarcane, and corn; recycled viscose fibers from wood and pulp; recycled cotton fibers); Seasonal feature products (with lightweight, sweat-absorbent, and UV-resistant fabrics for spring and summer; blended fabrics with wool and other fibers for autumn and winter, providing warmth and comfort); Convenient lifestyle products (mainly elastic, durable, and versatile products).

Lastly, E-Land wants to apply its experience in South Korea to develop TCM’s retail channel in Vietnam, but we believe they have not been successful in this area. During the 2010-2011 period, the company opened 20 stores in major cities such as Hanoi, Ho Chi Minh City, but there is no information about these stores to date.

03 Current position in the industry

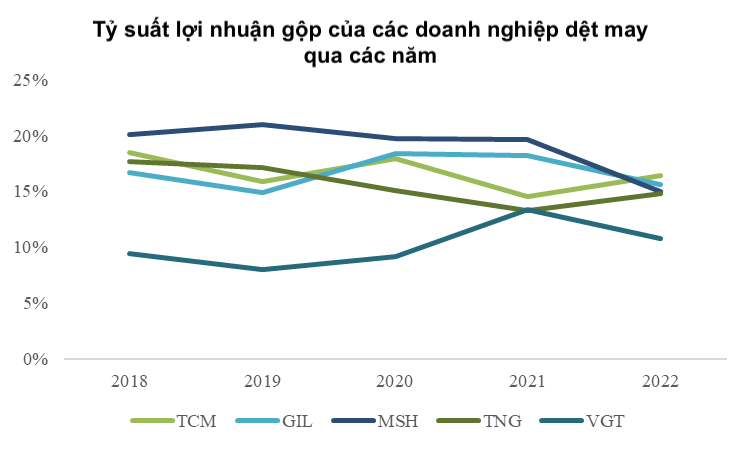

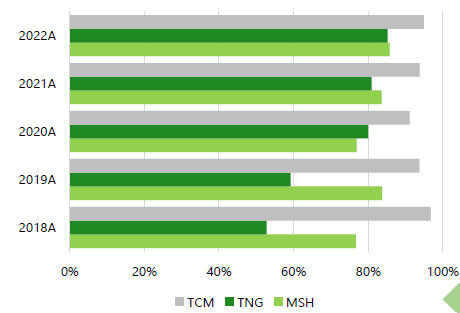

Compared to other enterprises in the industry, TCM’s revenue is only at a moderate level, but its gross profit margin ranks among the top 3. Especially in 2022, when raw material prices surged, TCM emerged as a leader with a gross profit margin of 16.4%. This is attributed to TCM’s complete supply chain advantage (including procurement of raw materials and accessories, sample design, production, packaging, ironing, and product transportation) and a high percentage of FOB orders (Free On Board – the manufacturing facility is responsible only for producing the goods and delivering them to the collection point, while additional costs such as transportation and insurance are borne by the ordering party).

In addition, TCM’s export market structure is less affected by the global macroeconomic situation compared to other companies in the industry.

TCM is not overly reliant on the export markets of the United States and Europe (in 2022, accounting for 31% and 3% of total revenue, respectively). Instead, South Korea and Japan are important export markets for the company, accounting for 32.5% of total revenue. These two countries still maintain relatively stable economic conditions, which may be the main driving force helping TCM recover better in terms of order quantities compared to the industry average. According to the information disclosed by TCM, the company has received 77% of the order plan for the third quarter and 75% of the order plan for 2023.

Finally, as a company benefiting from the Free Trade Agreement and one of the few enterprises with a relatively complete supply chain, TCM has the ability to meet the requirements of fabric and even fiber origin higher than other businesses. This not only allows TCM to enjoy preferential tariffs but also encourages other European export companies to purchase fabrics from Vietnam, including TCM, to benefit from tariff advantages.

04 ESG is the breakthrough

TCM has always been eager to explore and expand its retail market to achieve breakthroughs in revenue, initially through offline channels, and now through online channels.

In 2020, TCM launched the ONLEE fashion brand and directly exported products to the US market through the e-commerce platform Amazon (although it has now been discontinued – see image below). Additionally, the company introduced the DE CLOSET e-commerce website, specializing in selling clothing from other brands but facing tough competition from Shopee and Lazada. Therefore, we believe that developing online retail channels is not a new breakthrough for TCM, at least not this time.

Kirin believes that the main growth points for TCM are primarily focused on the following two aspects:

- Increasing the production output of raw materials, especially fabrics.

Mr. Nguyen Van Tuan, the former Chairman of the Vietnam Cotton and Spinning Association (VCOSA), pointed out that if we delve into various stages of the textile industry, we will find that the textile industry is bottlenecked in the middle, where yarn and garment development are robust, but fabric materials are lagging behind. According to the Vietnam Textile and Apparel Association (VITAS), over 50% of fabrics are still reliant on imports. Therefore, increasing fabric production not only caters to TCM’s own demand but also brings orders from domestic and foreign companies seeking preferential tariffs.

- Focusing on ESG in the industrial value chain

Developed countries, especially European countries, are imposing higher requirements on apparel products, including carbon taxes on imports and the necessity for fabrics to originate from Vietnam or the European Union. At the same time, Bangladesh, the world’s second-largest textile and garment exporting country, is increasingly emphasizing the implementation of environmental, social, and governance (ESG) responsibilities, which is the fundamental reason why Vietnam’s textile and garment industry is losing its competitive advantage. TCM’s chairman is well aware of this and has stated that the company has been implementing ESG practices for a long time, but now they will accelerate the implementation under customer pressure.

Kirin Capital is a research-driven equity investment company headquartered in Hanoi, Vietnam. Its core members have more than 20 years of financial experience in China and more than 10 years of financial and industrial investment experience in Vietnam. The investment covers TMT, large consumption, manufacturing, health care and financial services, and other fields, and spans all stages of equity investment such as seed investment, venture capital, private equity investment, listed company investment, and M&A investment.

Our vision is “Know Vietnam, Long Vietnam”. Through rich financial experience and local resources, we will be a guide for investors at home and abroad to invest in Vietnam and share Vietnam’s rapid growth development dividends.

If you have any needs related to the Vietnam market or would like to participate in our Kirin Views program and share your insights into the local market, please feel free to contact us HERE