Kirin Views is the second series of Kirin Capital towards the goal of “Know Vietnam, Long Vietnam”. This column provides Kirin’s observations and opinions on Vietnamese market through in-depth research driven by an expert team with decades of experience, assisting investors at home and abroad in better understanding the potential opportunities of Vietnam and join hands with “Know Vietnam, Long Vietnam”.

Vietnam’s summer seems to have arrived earlier and with greater intensity this year. In the northern regions, temperatures exceeding 40 degrees Celsius, previously considered rare occurrences, have become a daily occurrence for the Vietnamese people. In the southern regions, hot weather persists for over 300 days a year. To beat the heat, the Vietnamese have two options: either enjoy an ice cream (as discussed in the previous issue featuring KIDO) or have a glass of beer.

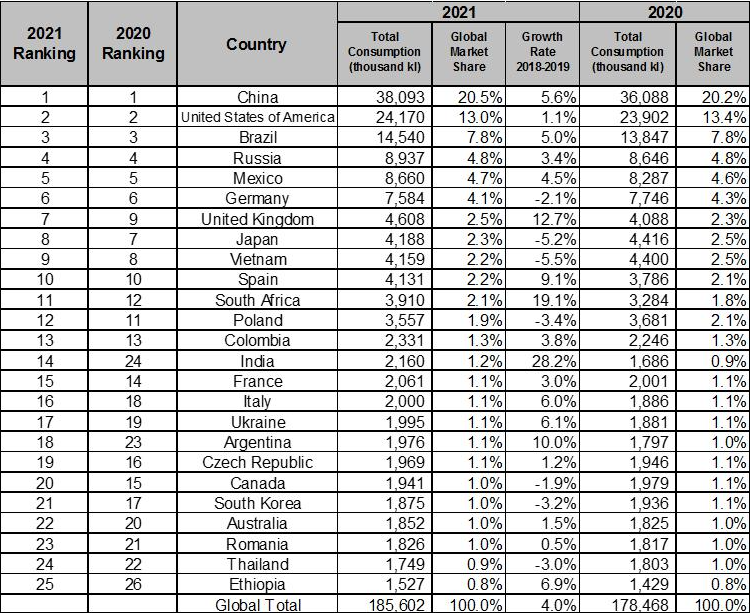

Compared to ice cream, beer is the preferred choice of Vietnamese during the summer. Its consumption is not limited to social gatherings among friends but also serves as an essential catalyst for business meetings. In 2021, the Vietnamese beer consumption market reached a staggering 4.16 billion liters, accounting for approximately 2.2% of the global market and ranking first in Southeast Asia. Vietnam is the only Southeast Asian representative in the top ten beer-consuming countries worldwide.

China, a country with a population fourteen times larger than Vietnam, holds the title of the world’s largest beer consumer. However, the consumption volume is only nine times higher. On average, the Vietnamese people consume more beer per person than the Chinese [1]. Statistics show that Vietnamese individuals aged 15 and above consume an average of 170 liters of alcoholic beverages annually [2]. The beer industry is predicted to experience a Compound Annual Growth Rate (CAGR) of 11% from 2023 to 2026.

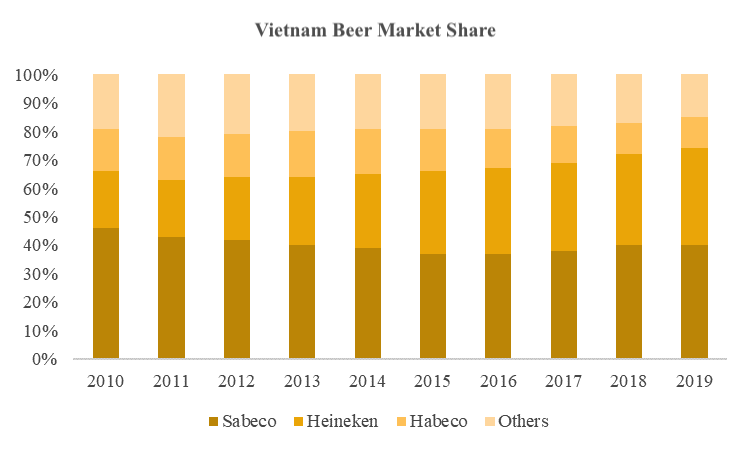

Surprisingly, both of the top players in this highly promising market are foreign companies. The first place is occupied by Heineken, a Dutch beer brand, with a remarkable market share of 44.4% in 2021. The second place is held by Sabeco, a beer company owned by Thai investors, with a market share of 33.9% [4].

Although both are foreign companies, Sabeco, which stands for Saigon Beverage Company, was originally a fully Vietnamese-owned beer production company, with the government holding a 89.59% stake. In this issue, we will explore how Sabeco, which once dominated the entire Vietnamese beer market, transformed into the second-ranking foreign enterprise it is today.

01 Oolong incident turns into a marketing technique

The predecessor of Saigon Beer was a small brewery established by a Frenchman named Victor Larue in Saigon in 1875. It later developed into the BGI Beer Company in September 1927.

The original logo of the company featured a tiger. However, in 1973, they decided to change the logo and added hops – a key ingredient in beer production – on both sides of the tiger’s head. Since the Vietnamese artists were unfamiliar with the appearance of fresh hops, they based their drawings on dried hops, resulting in a shape that resembled a pineapple.

It wasn’t until the first batch of 100,000 bottles with the new design was produced that the French engineer, who was personally involved in beer production, realized that the hops were drawn incorrectly. However, it was too late to make any changes. The company could only place one bottle of the new design in each six-pack. Seizing this opportunity, the Chinese distributors of Saigon Beer spread the news that the new design with a pineapple flavor tasted better.

The distributors’ claims, combined with the novelty of the new design (only one bottle per six-pack, making it more expensive), convinced consumers, who believed and praised the new flavor, even though the actual ingredients were the same.

This phenomenon actually serves as a lesson for companies selling beer in Vietnam, including Sabeco: the importance of brand packaging. Unfortunately, Sabeco only realized this many years later.

In 1977, the Minister of Agriculture and Food Industry issued Decision No. 845/LTTP, designating Southern Brewery Company to take over and manage BGI’s factory, which was then renamed as Saigon Beer Factory.

02 Taste trumps all

In the previous article featuring KIDO, we discussed whether Vietnamese consumers prioritize taste or brand when it comes to consumption, using ice cream and mooncakes as examples. However, it is not easy to draw a simple conclusion regarding beer consumption preferences. In the early stages of the beer market, brand concepts had not yet been established, and therefore, consumers placed more emphasis on taste.

Sabeco’s beer, compared to other brands, had a slightly higher alcohol content (5.3%) and a better, more flavorful taste. The ingredients, such as barley and hops, still needed to be imported. From 1985 to 2000, the company introduced new variations, but most of them were regular offerings such as Saigon Export, 333 Export, and Saigon Lager, available in both bottles and cans, priced at around 12.000 VND per 330 milliliters. In 2000, Sabeco launched a mid-range to premium beer called Saigon Special, available in green bottles or cans and priced at 15.000 VND per 330 milliliters.

There are primarily two distribution channels: on-trade and off-trade. Off-trade includes modern channels such as supermarkets, convenience stores, e-commerce platforms, as well as traditional channels like grocery stores. On-trade refers to channels where customers purchase and consume products on-site, such as restaurants, bars, clubs, etc. During the pandemic, social distancing measures led to a shift in sales volume from on-trade to off-trade. To maintain revenue, Sabeco conducted promotions through e-commerce channels like Tiki, Lazada, Shopee.

Among the “Four Kings of Beer,” apart from Heineken, the remaining three brands—Hanoi Beer, Hue Beer, and Saigon Beer—are favorites of people in different regions of Vietnam. The southern region’s hot weather throughout the year contributes to a higher frequency of beer consumption, to some extent aiding Saigon Beer in becoming the “sales champion.” However, taste remains crucial. Hanoi Beer leans towards bitterness, while Hue Beer has an average taste, allowing Saigon Beer to gain popularity among people in the northern and central regions.

Therefore, as of 2019, Saigon Beer consistently held the top position in terms of sales volume (37-46%). Meanwhile, Heineken beer stood out with its focus on mid-range and premium products, gradually increasing its market share from 20% in 2010 to 34% in 2019, taking away a small portion of Saigon Beer’s market share.

03 Did Sabeco lose its crown solely due to Thailand’s investment?

Despite producing excellent-tasting Saigon Beer, the company failed to maintain its position as the top domestic brand. Sabeco’s largest shareholder, the Ministry of Industry and Trade, decided to retain only 36% of the shares with veto power and sold the remaining 53.59% stake to Charoen, the second richest Thai-Chinese businessman. This, to some extent, contributed to Sabeco losing its top position in 2021.

However, this billionaire investor is not new to the Vietnamese market. Previously, he acquired several companies, including the wholesale supermarket chain Metro Cash & Carry (now renamed Mega Market), a 20.39% stake in Vinamilk (Vietnam’s largest dairy company), as well as other retail and real estate companies.

It is evident that this billionaire aims to leverage his retail resources and channels in Vietnam to realize his dream of becoming the beverage king in Southeast Asia (he also acquired Singapore’s well-known beverage group, F&N). As a result, he made a significant investment of nearly $5 billion, equivalent to 320,000 Vietnamese dongs per share (with a face value of only 10,000 Vietnamese dongs), making it one of the highest-value foreign acquisitions to date.

However, this prominent investor in Vietnam seemed a bit impatient and lacked some qualities expected of an investor. Just three months after the acquisition, he “complained” to the Vietnamese government that Sabeco’s board of directors did not have “his people” (according to corporate regulations, new members can only join the board after six months). The Ministry of Industry and Trade was willing to cooperate, so the three leaders from Charoen’s companies were able to smoothly join the board and assume executive positions in the fourth month.

After the entry of Thai investment, Sabeco’s performance did not improve. Its revenue growth from 2018 to 2019 was a mere 5%, lower than the double-digit growth maintained in previous years before the acquisition. The former chairman of Sabeco even spoke critically at this year’s shareholders’ meeting, saying, “Currently, Heineken has far surpassed Sabeco. But when I was in charge, Heineken could only rank second. Why is the situation different now?” He also mentioned that the leaders of their generation understood the beer consumption habits of the people in all 63 provinces of Vietnam, something that Heineken couldn’t match. Unfortunately, in all these years, the new leadership had never sought their advice.

The somewhat gloomy situation of Sabeco today cannot be denied to have been influenced by the change in leadership, but we believe that it is not the sole key factor.

In fact, Heineken’s revenue has long surpassed Sabeco’s due to its higher product prices. As early as 2016, it was already around 8% higher than Sabeco, and the gap has been widening. In 2020, it was nearly twice as much as Sabeco’s revenue. Heineken targets a broader range of customers (offering regular, mid-range, and premium products, as well as popular fruit beers and zero-alcohol beers for women), has a premium packaging design, and benefits from being a foreign brand. This has allowed Heineken to maintain its top position in terms of sales and revenue in 2021.

This ultimately boils down to a significant reason: the improved living standards of the Vietnamese people, which make them prefer products that exude a sense of luxury. The perception of luxury can come from the brand, price, and packaging, and in these three aspects, Sabeco is clearly overshadowed by Heineken.

04 Is it still possible to start the brand upgrade now?

The reformed Sabeco, no longer plagued by internal conflicts, actually recognized the importance of brand packaging in 2020. This should have been realized during the design mishap in the 2010s.

Sabeco introduced two products, Lac Viet (meaning “optimistic Vietnam,” emphasizing its exclusivity to the Vietnamese people) and Saigon Chill (with a fresher taste catering to the preferences of young people), and also revamped the packaging design of its existing products. The company also released a limited edition called “63+1” during the New Year, which features a box of 64 beers symbolizing Vietnam and its 63 provinces, with each bottle’s design reflecting local Lunar New Year customs.

The initial phase of reforms showed some initial progress, with a year-on-year revenue growth of 32.6% and a profit increase of 40% in 2022, setting a new record. However, this high growth is clearly influenced by the downturn caused by the pandemic, and in reality, its revenue has not yet recovered to pre-pandemic levels.

Clearly, the road to reclaiming the crown is not easy. We also look forward to Sabeco, with its slightly superior taste, putting in enough effort to establish its brand and once again ascending to the throne, bringing glory to domestic brands in Vietnam.

Reference:

[1] Global Beer Consumption by Country in 2021, Kirin Holdings, 2022

[2] Training Conference on the Harmful Effects of Tobacco, Alcohol, and Sugary Drinks, Ministry of Information and Communications, 2022

[3] Beer industry overview at the beginning of 2023 – Challenges and opportunities for recovery in the second half of the year, VIRAC, 2023

[4] Beer in Vietnam, Euromonitor, 2022

[5] Economic Rhythm Electronic Newspaper, Bai Mu, 2021

Kirin Capital is a research-driven equity investment company headquartered in Hanoi, Vietnam. Its core members have more than 20 years of financial experience in China and more than 10 years of financial and industrial investment experience in Vietnam. The investment covers TMT, large consumption, manufacturing, health care and financial services, and other fields, and spans all stages of equity investment such as seed investment, venture capital, private equity investment, listed company investment, and M&A investment.

Our vision is “Know Vietnam, Long Vietnam”. Through rich financial experience and local resources, we will be a guide for investors at home and abroad to invest in Vietnam and share Vietnam’s rapid growth development dividends.

If you have any needs related to the Vietnam market or would like to participate in our Kirin Views program and share your insights into the local market, please feel free to contact us HERE