Kirin Views is the second series of Kirin Capital towards the goal of “Know Vietnam, Long Vietnam”. This column provides Kirin’s observations and opinions on Vietnamese market through in-depth research driven by an expert team with decades of experience, assisting investors at home and abroad in better understanding the potential opportunities of Vietnam and join hands with “Know Vietnam, Long Vietnam”.

Recently, the technology semiconductor competition between China and the United States has been intensifying. Since October 2022, the Biden administration has announced a series of export control policies, prohibiting Chinese companies from purchasing chips and chip manufacturing equipment without permission, citing national security interests as the reason for protection.

On July 3rd, China played a trump card by announcing export controls on items related to gallium and germanium, which are important raw materials in the global semiconductor industry.

Subsequently, on July 4th, Chinese stocks in related industries all rose as soon as the trading session opened, with the highest increase reaching 10%. The Vietnamese stock market was also affected, with stocks related to Information and Communication Technology (ICT) products consistently rising for the past week, some even hitting their daily price increase limit. In previous issues, Kirin Views has analyzed two giants in the ICT retail industry, MWG, and FPT. In this issue, we will continue to bring investors closer to the success story of one of Vietnam’s leading ICT distribution companies – Digiworld (DGW).

01 Providing Full-Service Solutions for Brands

Digiworld Corporation was founded in 1997, and primarily engaged in the business of electronic component products. In 2001, the company officially started distributing computer products for China’s Acer. By 2003, DGW began distributing printers for a US brand Lexmark.

Through these partnership deals, Digiworld realized that its role went beyond simply distributing products. They could leverage the company’s strengths and market understanding to help customers increase market share. As a result, Digiworld established a formula for success for both the cooperating brands and the company itself – Market Expansion Services (MES) – to realize a mutually beneficial mechanism.

MES provides comprehensive services to brands looking to enter new markets or expand their market share in existing markets, including five main areas:

- Market analysis and planning.

- Marketing.

- Import, warehousing, and logistics.

- Distribution and sales.

- After-sales service.

The mutual benefit is evident in the fact that for Digiworld, MES not only increases the company’s revenue but also serves as a tool to expedite and facilitate the expansion of the business into non-ICT sectors. Digiworld is the first and, up to the present time, the only ICT distributor to offer MES services.

02 Gradually Elevating Industry Leadership

Thanks to their steadfast commitment to MES services, the company has consistently maintained a high growth rate, exemplified by a CAGR (Compound Annual Growth Rate) of 26.3% during the 2012-2022 period. Especially in the two years of the pandemic, the increased demand for computers and mobile devices for online learning had a positive impact on the growth rates of these products, reaching 67% and 48%, respectively. Additionally, the capabilities of smartphones have continuously improved, and internet access has expanded, leading to increasing demand for mobile phones among the population. The top position in the revenue structure of products has shifted from tablets and laptops to mobile devices. Ranking third in the product revenue structure is office equipment, although there has been a decrease from 19.7% in 2017 to 15.1% in 2022.

Specifically, in the mobile phone segment, Digiworld began distribution in 2013 and has since primarily cooperated with four brands: Apple, Xiaomi, Huawei, and TCL, including both IOS and Android devices. Additionally, Digiworld is the only company operating the online-offline retail store systems for Xiaomi and Huawei in the Vietnamese market. This line of phones contributes to 48.7% of Digiworld’s revenue and holds a 15% market share in the Vietnamese mobile phone market.

Tablets and laptops account for 31.9% of Digiworld’s revenue and claim a 40% market share in Vietnam. The majority of cooperating brands in this category are large international brands such as HP, Dell, Asus, Lenovo, Apple, and more. Similar to mobile phones, the distribution channels for these products include traditional channels (family-run retail stores) and modern channels: telecommunications stores (Viettel, Vinaphone, Mobiphone), retail store systems (Thegioididong, FPT Shop), e-commerce channels (Shopee, Lazada, Tiki), and others.

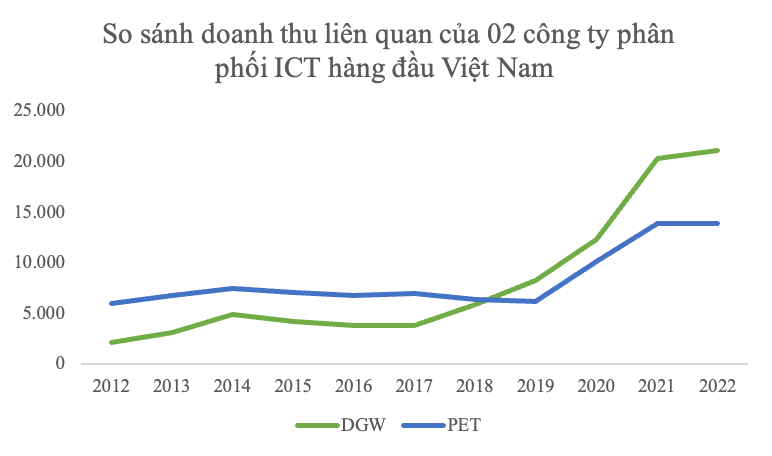

Kirin Capital conducted a comparison of sales revenue in related fields for two leading ICT distribution companies, Digiworld and PET. In 2019, the ICT sales revenue of Digiworld surpassed that of PET, and the gap has been narrowing. Through analysis, we believe there are two main reasons for this:

1, The full-service MES has helped Digiworld gain trust and selection from brands. After more than 20 years of dedication to MES, Digiworld has earned the trust of over 30 foreign brands who use this service.

2, The mobile phone product revenue of Digiworld in 2019 grew by 66% compared to the same period, with a significant contribution from Xiaomi. Digiworld has been providing MES services to Xiaomi since 2014 and officially secured the exclusive distribution certificate for this brand in 2017, continually helping Xiaomi increase its market share. The sweet fruit arrived in 2019 when Xiaomi’s market share exceeded 10% for the first time, reaching 14.8% by 2022, ranking third in the industry (Samsung was first with 36.6%, Oppo second with 20.4%, and Apple fourth with 13.1%).

03 Exclusive Distribution: A Double-Edged Sword?

As mentioned earlier, Digiworld elevated its position through exclusive distribution for Xiaomi, undoubtedly owing to Digiworld’s efforts and capabilities in helping Xiaomi rapidly increase its market share. However, by early 2022, Xiaomi had signed a cooperation agreement allowing Synnex FPT to distribute Xiaomi products in the Vietnamese market, breaking Digiworld’s exclusive position. This information directly impacted investor sentiment, causing DGW stocks to drop limit down for three consecutive sessions.

The reason investors reacted so strongly is because, in the past, in 2015, Digiworld experienced a significant drop in revenue. The main reason was the sharp decline in revenue from Nokia phones (accounting for 50% of Digiworld’s total revenue), which decreased by 64%, and even from 2016, it no longer contributed revenue to Digiworld. Therefore, investors’ concerns about the effectiveness of Digiworld’s operations when losing the exclusive distribution position with Xiaomi are entirely valid.

In response to this situation, Digiworld’s CEO has been candid and understanding. He believes that initially, Digiworld helped manufacturers explore and build their reputations. The next step is to drive sales and increase market coverage. The fact that manufacturers have additional distributors also marks their maturity in the market that Digiworld successfully pioneered.

The CEO of Digiworld also analyzes the difference between Digiworld’s partnerships with Nokia and Xiaomi. First, the current scale of the company is much larger. Xiaomi contributed only 35% to the total revenue in 2021, and Digiworld continues to implement a product diversification strategy. Second, Nokia at that time completely disappeared from the market (Nokia sold its mobile phone business to Microsoft and changed its business strategy to focus on software development rather than mobile phones). Regarding Xiaomi, the company still manufactures and sells phones, and as the brand’s market share increases, the revenue from Xiaomi will grow accordingly.

04 The Familiar Formula for Growth: Horizontal Expansion

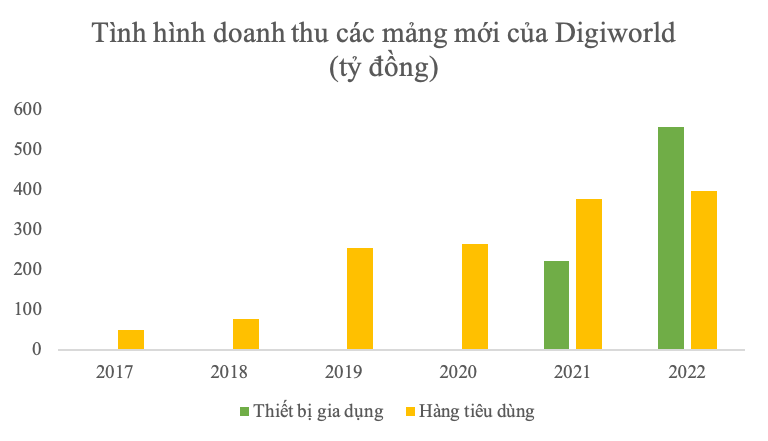

As we discussed earlier, MES enabled Digiworld to expand its business into other areas. The company completed its MES platform in 2016 and officially entered the consumer goods sector in 2017, including health protection products and fast-moving consumer goods.

Health protection products include products for men, products for protecting children’s health, products for cardiovascular health, digestive health, joint and bone health, and even mental health.

In the fast-moving consumer goods category, Digiworld is currently the exclusive distributor for the Japanese conglomerate Lion, which includes products such as oral hygiene products (the number one market share in Japan), soap (the largest market share in Japan), laundry products (the second-largest market share in Japan), and other personal hygiene products. At the end of 2022, Digiworld also partnered with the world’s largest beverage company (including brands like Budweiser and Corona) to officially enter the beverage sector. Shortly after, the company signed a contract with Lotte Chilsung, one of the largest soft drink manufacturers in South Korea, to distribute fruit juices and soda for children.

Not stopping there, Digiworld continued to expand into the home appliance sector. At the end of 2021, the company signed an exclusive MES distribution agreement with Whirlpool, one of the leading home appliance manufacturers with a 2020 annual sales of $19 billion. In early 2023, Digiworld partnered with the American home appliance brand Westinghouse to balance the declining demand for ICT consumer products.

In comparison, consumer goods have lower unit prices, so even though they have grown steadily over the years, this category accounts for only 1.8% of the company’s total revenue. On the other hand, home appliances have higher unit prices, so despite Digiworld’s entry in late 2021, the revenue for this sector surpassed consumer goods in 2022, accounting for 2.5% of the total revenue.

However, considering the overall economic difficulties at present, whether it’s consumer goods or home appliances, in the short term, they may not help Digiworld maintain explosive growth rates as during the “black swan” event.

Kirin Capital is a research-driven equity investment company headquartered in Hanoi, Vietnam. Its core members have more than 20 years of financial experience in China and more than 10 years of financial and industrial investment experience in Vietnam. The investment covers TMT, large consumption, manufacturing, health care and financial services, and other fields, and spans all stages of equity investment such as seed investment, venture capital, private equity investment, listed company investment, and M&A investment.

Our vision is “Know Vietnam, Long Vietnam”. Through rich financial experience and local resources, we will be a guide for investors at home and abroad to invest in Vietnam and share Vietnam’s rapid growth development dividends.

If you have any needs related to the Vietnam market or would like to participate in our Kirin Views program and share your insights into the local market, please feel free to contact us HERE