Kirin Views is the second series of Kirin Capital towards the goal of “Know Vietnam, Long Vietnam”. This column provides Kirin’s observations and opinions on Vietnamese market through in-depth research driven by an expert team with decades of experience, assisting investors at home and abroad in better understanding the potential opportunities of Vietnam and join hands with “Know Vietnam, Long Vietnam”.

In the previous issue, we examined the development history and current business landscape of Mobile World (Thế Giới Di Động), a prominent player in the Vietnamese market. However, there is another formidable competitor of Mobile World in Vietnam – FPT. The competition between these two companies is so intense that if you walk on the streets of Vietnam and come across a Mobile World store, you can easily find an FPT Shop selling 3C products within a radius of 500 meters.

Moreover, as a leading IT company in Vietnam, FPT not only competes fiercely with Mobile World in the downstream 3C retail sector but also engages in a battle of wits with them in various other domains, including retailing daily necessities and running pharmaceutical chain stores. So, how did FPT come to this point? How does it fare in comparison to Mobile World across its diverse business lines? These are the questions that will be addressed in this article.

01 FPT’s Journey to Success

FPT’s development can be divided into five stages:

1988-1997: Selling both software and hardware

Founder Prof.Truong Gia Binh, who graduated with a Ph.D. in Mathematics and Physics from Moscow State University, returned to Vietnam in 1982 to serve the country. However, initially, his work only involved drinking tea and reading newspapers in the office, earning a salary of around $5 per month.

Therefore, on September 13, 1988, at 13:13, he and 12 other colleagues decided to start their own venture and founded FPT. They set two goals: to support their families and themselves and to earn money for further research. Surprisingly, the number 13 became a lucky number for FPT, as any subsidiary or project established later on would be launched on the 13th of a certain year and month.

FPT initially started its business by selling digital software to various government departments, such as banks and telecommunications. Its first confirmed contract was in 1990 with Vietnam Airlines for the reservation system of their ticketing offices. Subsequently, FPT participated in computerization projects for key sectors in Vietnam, including banking, public finance, telecommunications, and electricity.

Additionally, FPT was one of the earliest companies to sell computer hardware in Vietnam. With the rapid development of personal computers in the 1990s, FPT took advantage of the lifting of the US embargo on Vietnam in 1994 to establish contacts with American companies and convince them to choose FPT as their official representative in Vietnam. This early success further solidified FPT’s professional image in the IT industry.

1997-2005: Embracing the Internet and expanding to Japan

In 1997, FPT became one of the first four licensed internet service providers, paving the way for providing broadband services directly to Vietnamese households. Moreover, after a decade of development, FPT had become the largest IT company in Vietnam and actively sought opportunities in overseas markets. In 2005, FPT became the first Vietnamese IT company to establish a legal entity in Japan.

2006-2012: Successful IPO and the establishment of a corporate university

In 2006, FPT went public on the Ho Chi Minh Stock Exchange, becoming not only the first but also the largest IT company in terms of market value. In the same year, FPT established FPT University, the first university established by a corporation, specifically focusing on programming education.

2012-2018: Venture into 3C and consumer goods retail

It took FPT 24 years to officially enter the 3C (Computer, Communication, and Consumer Electronics) retail sector. In 2012, FPT established a joint venture company called FRT, which operates a chain of 3C stores under the brand name FPT Shop. In 2016, they also opened several F.Studio stores dedicated to selling Apple products.

FPT’s subsidiary, FPT Online, also launched an e-commerce platform in 2012, named Sendo (meaning “lotus” in Vietnamese), which was the first domestic e-commerce platform for consumer goods retail at that time. In 2018, the retail joint venture company FRT went public on the Ho Chi Minh Stock Exchange.

2018-present: Venturing into the pharmaceutical industry and expanding digital services

In 2018, FRT established a subsidiary called FPT – Long Chau Pharmacy (nhà thuốc Long Châu), marking its official entry into the pharmaceutical retail sector.

During the same year, the FPT Group acquired a 90% stake in Intellinet, one of the fastest-growing digital consulting companies in the United States. Additionally, FPT also acquired Top 1, a Vietnamese enterprise management platform, to provide financial, inventory management, and other digital transformation consulting services to numerous domestic and international corporations.

So, how have FPT’s various businesses progressed in reality?

02 Current Status of FPT’s Business

From 2018 to 2022, FPT Group achieved a revenue compound annual growth rate (CAGR) of 16.8%, reaching 13.07 billion RMB by the end of 2022.

Among them, the technology business accounted for about 60% of the revenue, while the telecommunications business accounted for 33-38%, with the remaining portion allocated to education, investment, and other businesses. This article will primarily focus on analyzing the retail businesses of the group’s joint ventures and investee companies.

Let’s start with the 3C retail business, which falls under the joint venture company FRT.

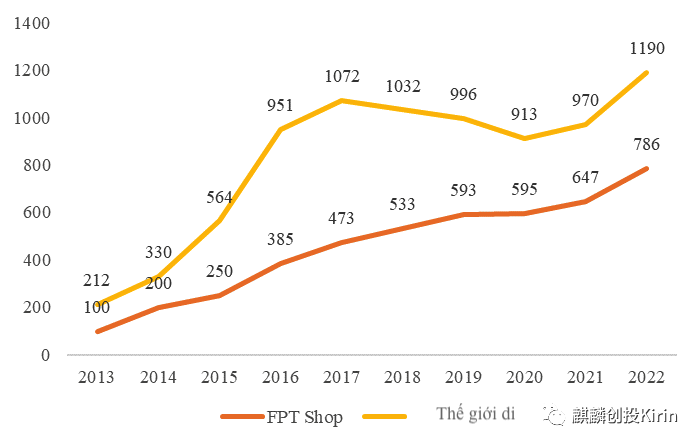

This business segment has maintained a strong position in the 3C market, with FPT Shop, its chain of stores, holding the second-largest market share in 3C products and ranking first in the computer market. In 2022, this business generated revenue of 6.18 billion RMB, accounting for 60% of Mobile World’s revenue.

Despite entering the market eight years later, FPT Shop achieved a revenue CAGR of 8.7% from 2019 to 2022, surpassing Mobile World’s 1.5%. There are two main reasons for this:

First, as one of the earliest companies to introduce computers and the internet to Vietnam, FPT has always had a more professional brand image in the IT field. Many consumers choose FPT Shop because they believe there will be more professional support in case of product issues, especially for products like laptops.

Second, FPT conducts a more detailed competitor analysis, identifying regions where Mobile World performs well and opening stores nearby to compete for head-on. While ensuring revenue growth, this approach also minimizes the risk of poor sales and store closures, adopting a steady and cautious strategy.

Meanwhile, FPT Shop’s upstream supplier is a related company called Synnex FPT, which is the wholesale distributor for most 3C brands. Therefore, FPT has certain advantages in terms of procurement cost and speed.

In terms of customers, FRT, the parent company of FPT Shop, also collaborates with the top three consumer finance companies (FE Credit, Home Credit, and HD Saigon) to offer consumer loan services. Additionally, the company conducts F.FRIENDS activities to seek cooperation with other companies and sign partnership agreements. Under these agreements, the partner companies’ employees can enjoy a 6-month interest-free installment plan for their purchases, or they can receive benefits such as mobile phone credits equal to 5% of the phone’s price if they choose to pay in full. For installment payments, the monthly installments are deducted directly from the employees’ salaries. Essentially, FRT aims to provide consumer loans itself but with lower risks compared to consumer finance companies because the customers (employees of partner companies) have a more stable cash flow.

Regarding product categories and brands, similar to Mobile World, FPT Shop expanded its offerings to include household appliances starting in June 2021. As of early 2023, there are already 300 stores selling household appliances.

In terms of distribution channels, FPT also adopts an O2O (online-to-offline) model, with online revenue accounting for a significant portion, reaching 19% by the end of 2022.

After realizing that the 3C market was becoming saturated, FRT wasted no time in entering the pharmaceutical market.

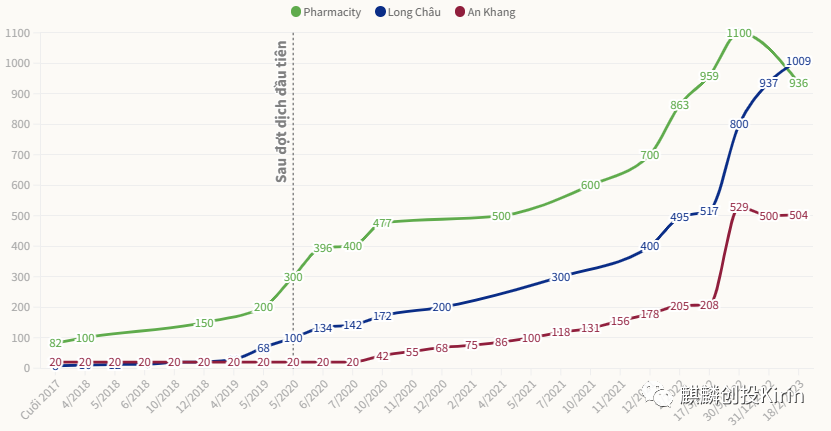

Although Mobile World also began investing in chain pharmacies through its investment in An Khang Pharmacy, its strategy was relatively conservative. In contrast, FRT pursued an aggressive strategy for Long Chau Pharmacy, rapidly expanding its store network. By 2022, the number of Long Chau Pharmacy stores had reached 1,000, twice the number of An Khang Pharmacy stores.

Such rapid expansion has been accompanied by a significant increase in revenue. From 2019 to 2022, its compound annual growth rate (CAGR) reached 165.8%, and by 2022, the revenue had reached 2.86 billion RMB, which is 6.4 times that of Mobile World’s An Khang Pharmacy. In just four years, Long Chau Pharmacy successfully secured the top position in the chain pharmacy market, with a market share of 45% as of the third quarter of 2021, surpassing the previous leader, Pharmacity, in terms of scale and revenue.

Long Chau Pharmacy achieved profitability as early as 2021, something that other chain pharmacies have yet to accomplish. Its success can be attributed to the following reasons:

First, strong support from FPT. The rapid expansion of pharmacies often requires a significant number of pharmacists. Long Chau Pharmacy secured a portion of its pharmacists through interactions with various medical schools in Vietnam. Additionally, all pharmacists at Long Chau undergo “real-world” drug consultation skills training using the “Virtual Simulation Room” application developed by FPT. As a result, seamless and uninterrupted training activities ensure that pharmacists can keep up with the expansion of the stores. FPT also developed an AI algorithm project that calculates which brand of cold medicine should be sold in a particular area, reducing the pressure of dealing with expired inventory and improving its supply chain.

Second, reasonable pricing. FRT Chairman Nguyen Bich Diep guaranteed that 80% of Long Chau’s products are cheaper than the market, some even by several tens of percentage points. Initially, this involved voluntarily reducing gross margins, but as cooperation with international pharmaceutical companies deepened, Long Chau was able to obtain cheaper drugs from the upstream suppliers and receive pharmacist training from these pharmaceutical companies.

Concerning the worry that profit margins would be lower when opening stores in non-major cities, Ms. Nguyen stated that some provincial cities also have a good standard of living, allowing for the sale of imported drugs from countries such as France, Australia, and India. Furthermore, whether it’s imported or domestically produced drugs, Long Chau maintains the same profit margin.

During the pandemic, when many pharmacies or small businesses deliberately raised prices for masks and COVID-19 treatment drugs, Long Chau gained a positive reputation by guaranteeing the availability of a large number of masks and medicines at reasonable prices.

Third, clear brand positioning. Before the emergence of Long Chau Pharmacy, the market-leading Pharmacity positioned itself as a store that offers both pharmaceutical and daily-use products, resulting in only 30-40% of its products being medicines and supplements. However, Vietnamese people visit pharmacies only to buy medicine, so Pharmacity gave the impression of being a pharmacy with limited medicine options and high prices. In comparison, Long Chau Pharmacy maintains a high proportion of 80% for medicines and supplements, creating a highly professional image for consumers.

Fourth, customer-centric service. Personal experience reveals that even for a simple headache symptom, a 15-minute consultation service was provided, without any aggressive promotion of supplements. In the end, only a 10,000VND painkiller was sold. Additionally, the pharmacist recommended using the app for consultations and ensured that even for a 10,000VND medicine, home delivery would be provided free of charge. Furthermore, unused medicines or prescriptions from doctors can be returned to the store.

03 Conclusion

FPT’s various strategies in the retail business are worth learning for entrepreneurs:

- Synergy: Despite being a latecomer, FPT Shop quickly expanded its market share by leveraging the group’s reputation in the IT industry. Long Chau Pharmacy also uses software developed by the group to provide continuous and rapid training for pharmacists. They can also identify consumer preferences in each region and adjust their medication stock accordingly.

- Advantages of being a latecomer: FPT Shop can analyze the areas where Mobile World performs well and open stores nearby, saving a significant amount of costs associated with trial-and-error market exploration. Additionally, Long Chau Pharmacy recognized the flaws in Pharmacity’s model of selling both pharmaceutical and daily-use products, allowing them to position themselves better in the market.

Kirin Capital is a research-driven equity investment company headquartered in Hanoi, Vietnam. Its core members have more than 20 years of financial experience in China and more than 10 years of financial and industrial investment experience in Vietnam. The investment covers TMT, large consumption, manufacturing, health care and financial services, and other fields, and spans all stages of equity investment such as seed investment, venture capital, private equity investment, listed company investment, and M&A investment.

Our vision is “Know Vietnam, Long Vietnam”. Through rich financial experience and local resources, we will be a guide for investors at home and abroad to invest in Vietnam and share Vietnam’s rapid growth development dividends.

If you have any needs related to the Vietnam market or would like to participate in our Kirin Views program and share your insights into the local market, please feel free to contact us HERE