Kirin Views is the second series of Kirin Capital towards the goal of “Know Vietnam, Long Vietnam”. This column provides Kirin’s observations and opinions on Vietnamese market through in-depth research driven by an expert team with decades of experience, assisting investors at home and abroad in better understanding the potential opportunities of Vietnam and join hands with “Know Vietnam, Long Vietnam”.

In the Mid-Autumn Festival last year, a new player emerged in the Vietnamese mooncake market – Kido’s Bakery. Due to the similarity in pronunciation between “Kido” and “Kinh Đô,” there were even suspicions that this was a knockoff version of Kinh Đô mooncakes (another mooncake company in Vietnam).

In fact, the two brands have a specific connection: In 2015, KIDO Group transferred the Kinh Đô brand to Mondelez USA. Six years later, the company returned to the confectionery market with Kido mooncakes, directly competing with the brand that was once its own – Kinh Đô.

Behind this seemingly melodramatic story, what kind of development and changes does Vietnam’s snack food industry reflect? This is the question this article will answer.

01 KIDO’s Path to Success

Kido’s development can be roughly divided into four stages:

1993-2002: Leading snack production company that started with selling puffed snacks

Kido Group, formerly known as Kyoto Food Production and Processing Limited Liability Company, initially started from a private bakery and a capital of 0.3 taels of gold (equivalent to 1 USD). The founders were Chen Jincheng, the older brother born into a family of biscuits and sweets, and his younger brother Chen Liyuan. Despite their childhood dream of becoming scientists, the brothers eventually ventured into the snack business.

In addition to snacks, the company quickly expanded its production to include cookies, pastries, mooncakes, and chocolates. In 2002, Kyoto Corporation was established.

2003-2014: M&A of ice cream and beverages, expanding SKU

In 2003, the company acquired Wall’s – Unilever’s ice cream factories in Vietnam and launched two brands, Merino and Celano.

In 2005 and 2007, KIDO successively bought the shares of Tribeco and Nutifood, both of which belong to the beverage market. However, due to the different development strategies, KIDO eventually had to exit with losses.

As of 2014, KIDO has achieved the first market share in both the snacks and mooncake markets, with 19% [1] and 76% [2] respectively.

2015-2019: Abandoning the biscuit and candy business, focusing on ice cream and edible oil

As the consumption of biscuits and candies is not frequent enough, and the invasion of foreign brands has intensified the competition, the founder of KIDO decided to sell the business to the American snack manufacturer Mondelez for US$490 million in 2015. And signed a contract to promise not to operate biscuit and candy products within 5 years.

Afterward, KIDO held 75% of Tường An (the largest edible oil market share), 51% of Vocarimex (the first industrial oil market share), and Golden Hope Nhà Bè (the second largest edible oil market share) in 2016, 2017 and 2018 respectively, shifting the focus of their business to edible oil. The group’s ice cream products have also achieved a leading market share, maintaining a share of more than 40% for several years [3].

2020-Present: Re-entry to the snack market, moving closer to the goal of Vietnam’s No. 1 Food Group

One year after the contract with Mondelez expired, KIDO began to return to the snack, bread, and mooncakes market. The main reason was that many of KIDO’s former distributors continued to approach them, as the group had been assisting Mondelez with the distribution. Therefore, instead of relying on old resources to open up a “new” market, KIDO innovated by choosing niche products with high demand, rather than following the previous mass distribution approach. The KIDO’s Bakery brand was officially launched in Q3/2022.

In the beverage market, KIDO did not give up either. In 2021, they formed a joint venture with Vinamilk (the largest dairy company in Vietnam) to establish Vibev, a company selling fresh milk and ice cream, in which KIDO holds a 49% stake. However, a year later, the joint venture dissolved due to strategic changes by the two major groups. In the same year, KIDO also opened a milk tea and coffee chain store called Chuk, with three different formats: stores ranging from 100-150 square meters located in commercial areas or main roads, 20-square-meter kiosks in business centers, and around 3-square-meter hand carts in densely populated residential areas. Currently, the expansion speed is not proceeding as planned, indicating that the group is being more cautious.

Furthermore, after experiencing a failed attempt at producing buns, KIDO acquired a 51-70% stake in Bánh Bao Thọ Phát (Vietnam’s top bun brand) in Q2 of this year, and the dream of Vietnam’s No.1 Food Group seems to be further advanced.

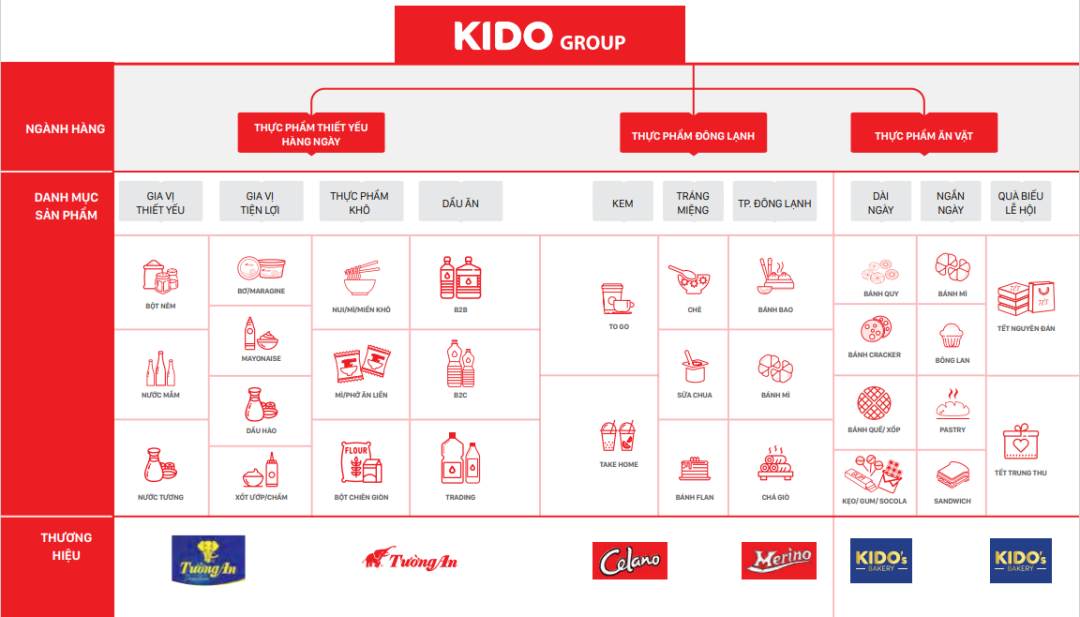

02 Current Status of KIDO’s Business Segments

KIDO’s revenue is composed of two main business segments: edible oil and food. Edible oil accounts for over 80% of the revenue, while ice cream represents a significant portion, ranging from 14% to 18%. Seasonings and snacks make up a negligible portion of the revenue.

Now let’s take a closer look at how well KIDO has performed in its two major business segments through mergers and acquisitions.

The first major business segment, including edible oil and butter, achieved a CAGR of 13.6% from 2017 to 2022, surpassing the market’s overall growth potential of 8.8% for the period of 2020-2025 [4]. Edible oil and butter have market shares as high as 39% and 79% respectively [5], ranking second overall. However, the gross profit margin for edible oil is only 12-16%, providing only half of the company’s profits.

On the upstream side, the company owns one refinery, one oil mill, and three finished oil factories. Certain raw materials such as sunflower, rapeseed, and olive oil need to be 100% imported. On the downstream side, the company has a wide distribution network with 450,000 points of sale, including traditional channels and modern channels (supermarkets, convenience stores, e-commerce platforms, etc.).

The products are vegetable oils, divided into four categories: ordinary – for industrial use, intermediate – for household use, premium – for serving special populations (such as those with heart disease or obesity), and exclusive – catering to special preferences (such as oils made from special ingredients like sunflower, rapeseed, mahua fruit, and olive).

However, as people’s health awareness continues to grow, promoting a low-salt and low-oil diet, and considering the high prices of products that are beneficial for the body (costing five times as much as regular products), we believe the prospects for edible oil are not optimistic. KIDO is also attempting to launch new seasoning products under the edible oil brand Tường An to establish new growth points. However, the seasoning market situation is already established (as mentioned in the second phase, Masan is the largest player), and it is not easy to secure a decent market share.

Now let’s look at the second major business segment, ice cream. The growth of the food business, mainly driven by ice cream, has been unstable, with an average negative growth rate of 4.4% from 2017 to 2022. However, overall, KIDO is currently the leading player in the ice cream industry in Vietnam, with a market share of 44.5%. Among them, the Merino brand accounts for 24.2% and the Celano brand accounts for 19.2% [5]. The high gross profit margin of this business segment (over 50%) also contributes to half of the company’s profits.

On the upstream side, there are two frozen food factories that currently produce ice cream and yogurt, but not buns. On the downstream side, there are 120,000 points of sale, and it is easy to find KIDO’s ice cream products in modern channels such as supermarkets.

KIDO is well aware that consumers value the taste of ice cream more than the brand itself. With its R&D advantages, KIDO constantly introduces innovative flavors and taps into trends such as pearl milk tea, cheese, matcha, etc. The pricing is reasonable and covers a wide range of consumer groups, ranging from 3 to 10 RMB per serving.

The year-round hot weather in southern Vietnam and the habit of eating ice cream in winter among some young people slightly mitigate the seasonality of the ice cream business, and the market growth potential still reaches 8% [4]. However, the strong competition from flavors, as well as the entry of foreign chains (such as China’s Mixue and the popular American brand Swensen’s which is on trend in Thailand), make it difficult for KIDO’s ice cream business to achieve breakthrough growth.

Therefore, for KIDO, it is necessary and reasonable to choose to re-enter the snack market with high gross profit margins. The group intends to leverage its existing partners, accumulated experience in the snack market, and mature retail channels to quickly regain market share.

In 2022, after introducing mooncakes and bread products, the food business experienced year-on-year growth of 43%, but the gross profit margin decreased by 1.4%. According to statistics, the cost of mooncakes accounts for only 25-40% of the selling price. The decrease in gross profit margin indicates unclear sales conditions, with some products being heavily discounted or even directly discarded due to poor sales. Clearly, even though KIDO is the “father” of Kyoto mooncakes, consumers are only willing to pay for the brand. For KIDO to persuade consumers to try its new products, it requires significant advertising costs and time accumulation.

03 Kirin’s point of view

The ups and downs of KIDO’s story provide us with the following points to consider:

- The success of mergers and acquisitions lies in the buyer’s control over the target. In one of KIDO’s failed acquisitions, Tribeco, their ownership stake was only 35%, which was lower than Uni-President from Taiwan with 43%. As a result, they couldn’t influence the company’s development strategy.

- Unclear acquisition targets can be fatal. After purchasing Tribeco and Nutifood, KIDO surprisingly invested in their stocks and real estate instead of focusing on developing their core business. On the other hand, in acquiring the ice cream business, KIDO actively and swiftly transformed product flavors, adjusted advertising strategies, conducted market research, and set reasonable prices, with CEO Tran Le Nguyen personally involved alongside the employees.

- Understanding consumer considerations for brands and flavors is crucial. Ice cream, for example, leans more towards entertainment, where consumers prioritize flavors over brands. Therefore, continuously introducing new flavors is essential. On the other hand, mooncakes are associated with formal occasions and social purposes, making the brand highly important. Despite KIDO introducing many unique flavors, the suspicion of imitating other brands remains a significant obstacle for consumers to make a purchase.

Reference Materials:

[1] Vietnam Industrial and Commercial Bank Securities, 2015 [2] Representative of KIDO Group, 2014 [3] Euromonitor International, 2020 [4] Company’s 2022 Annual Report, 2023 [5] Euromonitor, 2022Kirin Capital is a research-driven equity investment company headquartered in Hanoi, Vietnam. Its core members have more than 20 years of financial experience in China and more than 10 years of financial and industrial investment experience in Vietnam. The investment covers TMT, large consumption, manufacturing, health care and financial services, and other fields, and spans all stages of equity investment such as seed investment, venture capital, private equity investment, listed company investment, and M&A investment.

Our vision is “Know Vietnam, Long Vietnam”. Through rich financial experience and local resources, we will be a guide for investors at home and abroad to invest in Vietnam and share Vietnam’s rapid growth development dividends.

If you have any needs related to the Vietnam market or would like to participate in our Kirin Views program and share your insights into the local market, please feel free to contact us HERE