Kirin Views is the second series of Kirin Capital towards the goal of “Know Vietnam, Long Vietnam”. This column provides Kirin’s observations and opinions on Vietnamese market through in-depth research driven by an expert team with decades of experience, assisting investors at home and abroad in better understanding the potential opportunities of Vietnam and join hands with “Know Vietnam, Long Vietnam”.

The daily consumption of contemporary Vietnamese youth is likely inseparable from Masan.

They make a bowl of Omachi instant noodles in the morning, prepare a pack of Vinacafe when arriving at the office, use the Techcombank App to transfer money to colleagues after lunch and buy a cup of oolong tea at Phuc Long in the afternoon.

At 5 pm, they head to Winmart+, which can be found every 500 meters, to buy some Meat Deli pork belly and fresh lettuce from WinEco and Chin-Su chili sauce and soy sauce – all set for a delicious barbecue party. Before leaving, they remember they’ve run out of laundry detergent, so they grab a bag of Joins to take home.

Masan is currently the largest comprehensive consumer enterprise in Vietnam with a 27-year history. So, how did this Vietnamese consumer giant come about? How is it currently developing? This article will answer the questions.

01 The Development Journey of Masan

The development of Masan can be divided into three stages:

1996-2009: Starting with instant noodles, rising with seasoning products

Masan’s founder, Nguyen Dang Quang, had studied in Russia and obtained a Ph.D. in nuclear physics. He is also a friend of Vietnam’s richest man Pham Nhat Vuong, who studied in Eastern Europe.

Masan’s business started when Nguyen Dang Quang planned to sell instant noodles to Vietnamese people living in Russia. However, it gradually attracted local people and even earned the title of “teaching Russians how to eat instant noodles and chili sauce.” Thus, the predecessor of Masan, Vietnam Trade and Technology Company, was established in 1996, with an average monthly production of 30 million packs of instant noodles.

After Vietnam opened up to the world, overseas Vietnamese returned home, and Nguyen Dang Quang also returned to Vietnam to seek business opportunities. However, his first product wasn’t instant noodles, but soy sauce, which was launched in 2002 under the brand name Chin-su. Since then, Chin-su introduced various new products, including fish sauce, chili sauce, and instant noodles. However, the Vietnamese instant noodle market at that time was mainly dominated by Japan’s Acecook and local brand Vifon, and Chin-su instant noodles were not popular.

In 2007, the company launched Omachi potato noodles, which belong to the middle and high-end market. At that time, TV advertisements of “Vietnam’s first instant noodles containing potato fiber, delicious and not hot” could be seen everywhere, hitting consumers’ long-standing concerns about eating instant noodles. Therefore, Omachi quickly grabbed the market share and has reached the second market share in Vietnam’s instant noodle market so far.

In 2008, the company was restructured and named Masan Group Corporation, holding a 20% stake in Techcombank, in order to further serve Vietnam’s middle class at that time. After Masan went public in 2009, it immediately became the sixth largest company in terms of market value and introduced investment from TPG, a leading global alternative asset management company.

2010-2018: Horizontal expansion, entering the beverage and fresh food market

In 2011, Masan entered the beverage market by acquiring a stake in Vinacafe Bien Hoa, the largest manufacturer of instant coffee. The group continued to expand in the beverage market by acquiring Vinh Hao, the largest mineral water company in Vietnam, and Phu Yen Beer in 2014.

In addition to the beverage market, Masan established Masan Nutri-Science in 2015 and bought a 24.9% stake in Vissan, the largest meat processing company in Vietnam in 2016. This move aimed to penetrate and transform the value chain of the Vietnamese meat market.

Masan also ventured into the rare metal mining and processing industry by acquiring a stake in Nui Phao, one of the world’s largest tungsten mines, in 2010. In 2014, Masan Resources was established, and the processing plant began operations.

2019-Present: Vertical integration and establishing proprietary offline channels

In July 2019, Masan Nutri-Science was renamed Masan Meatlife and completed its transformation into a branded meat company. As of today, Meat Deli has become the representative brand of fresh meat products.

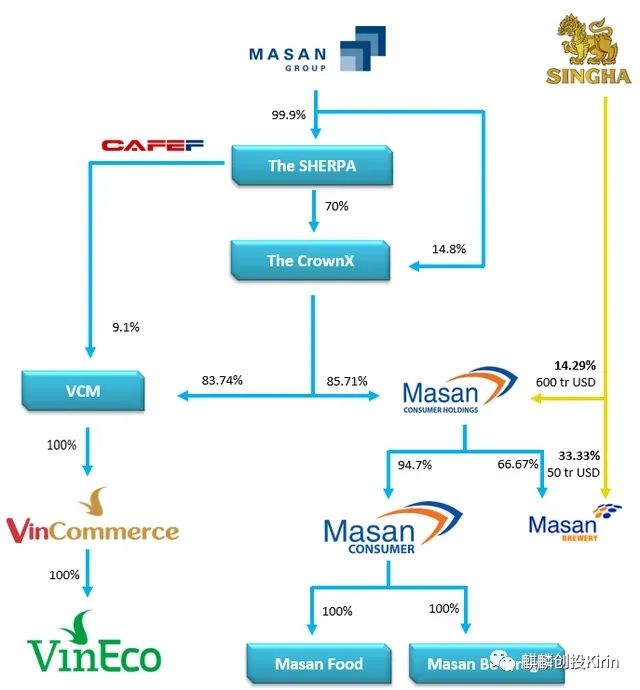

In December 2019, Masan Consumer, a subsidiary of Masan, merged with Vincommerce, a retail company under Vin Group (including VinEco, a subsidiary of Safe Vegetables), which is known as the largest merger and acquisition in Vietnam’s retail consumer industry. After the merger, the new company The CrownX became the parent company of the two, and Vincommerce’s “Vin” was changed to “Win”. Vinmart withdrew from the stage of history, and Winmart rose gradually.

Masan also expanded the consumer goods category to personal care products and bought NET laundry detergent company in 2020. The group also bought a 51% stake in Phuc Long, the most popular Vietnamese version of Starbucks, in 2021-2022, and opened a Phuc Long kiosk in Winmart+ to enhance the shopping experience while attracting customers.

Therefore, Masan is committed to building a complete consumer ecosystem, including catering (Phuc Long), healthcare (Dr.Win), digital payment (Techcombank’s T-pay), logistics platform (new company Supra), and mobile virtual network (buying Reddi operator and renaming it Wintel), hoping to solve the daily problems of Vietnamese people through its proprietary offline channel Winmart and making the “WIN” stores the focal point of everyone’s life.

However, since Masan operates so many businesses at the same time, is each business doing well?

02 Status of Masan’s businesses

Let’s start with its main business – F&B (Food and Beverage).

Its categories include seasonings, instant noodles, meat products, instant coffee, beverages, etc. Among them, Chin-su and Nam Ngu seasonings, Omachi high-quality instant noodles, Vinacafe and Wake up instant coffee all firmly hold the top spot in the market. Masan Consumer was among the top three fast-moving consumer goods companies in Vietnam in 2022 [1].

This is due to Masan’s marketing strategy over the years, which has spent a lot of money on celebrity endorsements through traditional media (TV) and social media (Facebook), and also sponsored food variety shows with products such as fish sauce and chili sauce.

At the same time, the sales channels have also changed from traditional vegetable markets or kiosks to supermarkets or convenience stores – such as Winmart, Big C, Lotte Mart, etc.

This business segment brings in around 35% of the group’s revenue, with an average annual revenue growth rate of up to 20% from 2017 to 2021. In 2022, revenue decreased by 3% due to the impact of panic buying in the previous year and declining consumer demand. The gross profit margin remains above 40%, and the net profit margin was as high as 21% in 2022.

Next is the offline retail business, managed by Wincommerce, including the operation of Winmart and Winmart+, accounting for around 38% of revenue. After taking over VinCommerce, Masan invested heavily in its original products in Winmart/Winmart+, and on the other hand, adjusted the sales categories according to different consumer groups and the cultural lifestyle of various regions, but still maintained a 90% ratio of domestic products.

The new logistics company, Supra, uses AI and machine learning to identify the stores with the highest sales of goods, automatically place orders and calculate delivery routes to optimize transportation costs. The new type of store, “WIN,” which combines multiple functions into a “Point of Life,” opened 102 stores in the fourth quarter of 2022.

The results have been remarkable, with the company’s gross profit margin increasing from 17% in 2020 to 23% in 2022, and the EBITDA rate turning from a loss to a profit, from -7.4% before the merger to 2.7%. However, due to the high base brought about by the earlier pandemic hoarding, revenue in the three years after the merger showed a slight decline of 0.5-5%.

The third largest business contributing to Masan’s revenue is the mining and processing of rare metals, including tungsten ore, fluorspar, and bismuth ore.

After completing the acquisition of the tungsten business platform of HC Starck Group in 2020, Masan’s subsidiary Masan High-Tech Materials (MSR) has successfully transformed into one of the world’s top high-tech tungsten (midstream products) production companies. This means that Masan has mastered the upstream and midstream in the supply chain in the fields of 3D printing, automotive, energy, aviation, and so on.

MSR contributed about 20% of Masan’s revenue. After the transformation, the average annual growth rate of revenue was as high as 49%, and the gross profit margin remained at 15%. However, the profit margin was only around 1% after the high-interest expenses and exchange losses.

03 Looking ahead: Masan’s future prospects

For the future development of Masan, we have three views:

In the F&B sector, the focus should be on quality over quantity. Although modern consumers are pursuing product diversification, it is often difficult to succeed in a market dominated by a few major players without a core competitive advantage.

Beer is a good example. As of 2021, Vietnam’s beer CR4 is as high as 94.4%, and CR2 is also as high as 78.3% [2]. Masan has tried twice to establish its own beer brand, but the results are unknown. After acquiring the largest domestic distributor Winmart, the beer dream has been revived. In July 2022, Masan applied for and obtained a license to build a beer factory. The situation is clearly more optimistic than the previous two attempts, but we still believe it will be a long and difficult road.

In the retail sector, the speed of opening new stores should be slowed down. Masan opened 730 Winmart+ stores and 8 Winmart stores in 2022 and plans to open 800-1200 more in 2023, citing improved EBITDA performance last year. Obviously, the group underestimated the impact of this year’s economic downturn, which not only led to an overall decrease in consumer purchasing power but also caused some unemployed people to return to their hometowns, directly affecting the revenue of urban stores. Therefore, we suggest that the group adjust its expansion plan in real-time based on changes in revenue.

Finally, to increase revenue, it is obviously more cost-effective and long-term effects to improve online channels than to open physical stores. Before the two companies merged, Winmart already had its own online channel, which was entrusted to the e-wallet “VinID” for shopping. However, it was not done well.

Pick-up at convenience stores can be obtained on the same day, but this is not much different from offline purchases. Home delivery services take a day and the delivery fee is not cheap (up to RMB 8 for a distance of less than 500 meters). The three-year pandemic has caused Vietnamese people to try and slowly rely on online shopping, especially as work becomes increasingly busy. It is obvious that improving online channels will not only increase Masan’s revenue, but also avoid the costs and risks faced by physical stores.

References:

[1] Vietnam Brand Footprint, Kantar Vietnam, 2022

[2] Beer Industry Analysis Report: Recovery after the Epidemic, MB Securities, 2022

Kirin Capital is a research-driven equity investment company headquartered in Hanoi, Vietnam. Its core members have more than 20 years of financial experience in China and more than 10 years of financial and industrial investment experience in Vietnam. The investment covers TMT, large consumption, manufacturing, health care and financial services, and other fields, and spans all stages of equity investment such as seed investment, venture capital, private equity investment, listed company investment, and M&A investment.

Our vision is “Know Vietnam, Long Vietnam”. Through rich financial experience and local resources, we will be a guide for investors at home and abroad to invest in Vietnam and share Vietnam’s rapid growth development dividends.

If you have any needs related to the Vietnam market or would like to participate in our Kirin Views program and share your insights into the local market, please feel free to contact us HERE