Kirin Views is the second series of Kirin Capital towards the goal of “Know Vietnam, Long Vietnam”. This column provides Kirin’s observations and opinions on Vietnamese market through in-depth research driven by an expert team with decades of experience, assisting investors at home and abroad in better understanding the potential opportunities of Vietnam and join hands with “Know Vietnam, Long Vietnam”.

In the previous article, we mentioned that KIDO Group, in order to pursue its beverage dreams, had partnered with Vinamilk – a giant in the Vietnam milk industry, to establish a company selling fresh milk and ice cream. In addition to being a prominent milk figure, Vinamilk is also a good case study in financial analysis classes. What’s the key to their success? Let’s explore!

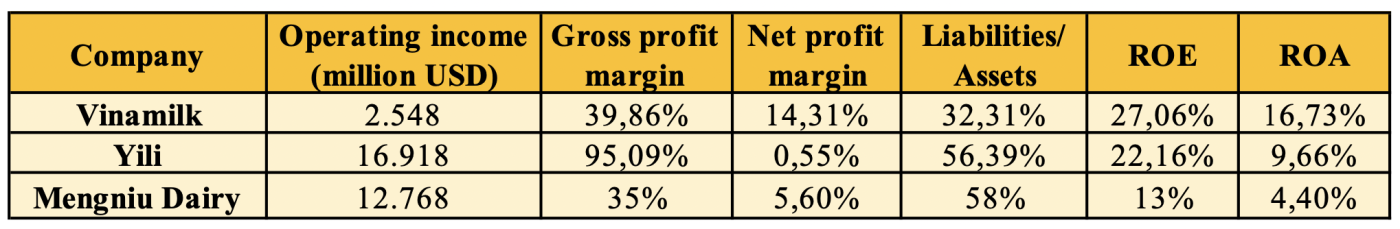

First, we compare the financial data of the Vietnamese dairy giant with the two leading Chinese companies in 2022. Although Vinamilk’s revenue is only 1/7 of Yili Group and 1/5 of Mengniu Dairy, its profitability indicators are significantly better. Its debt ratio is in an ideal state, with lower leverage than the two Chinese companies, which partly explains why Vinamilk’s net profit margin is nearly twice that of Yili Group and almost three times of Mengniu Dairy.

It is not easy for Vinamilk to achieve such good results. The 47-year development of Vinamilk is supported by the milk dream of executive director Mai Kiều Liên and the concerted efforts of all employees. The story began in 1976.

01 From being chosen by fate to the dream of providing high-nutrition milk for underprivileged children

Mai Kiều Liên, the CEO who has accompanied Vinamilk for 47 years, graduated from Moscow in the year of Vinamilk’s establishment. Her specialization was in meat and milk processing.

However, this specialization was not initially Mai’s intention. Born to parents who were both doctors, she had envisioned becoming a doctor or a teacher in the future. Perhaps it was fate’s arrangement that out of the 176 Vietnamese students sent to study in Moscow, only four were assigned to the meat and milk processing field, and Mai was among them.

At that time, Vietnam did not have any milk processing factories, and the only farm in the northern region had only a few hundred cows. This specialization seemed like a dead end. Disappointed, she sought advice from her father, and his response influenced her life profoundly: “The first problem to solve after the war is the nutrition of children and the health of people.”

This great concept propelled her to start from scratch at Vinamilk, working as a condensed milk and yogurt production engineer. After seven years, she went to the Soviet Union to further her studies in management. Upon her return, Mai became the Deputy General Manager of Vinamilk, and eight years later, she ascended to the position of General Manager (CEO). It was during this phase that the company’s development strategy quietly underwent changes.

02 Milk source is the key

In the early stages of any consumer industry, we believe that the key factor lies in distribution channels – the more consumers reach, the faster they can grow. However, once a company enters a period of stable growth, whoever can control the upstream supply chain will have the ability to control gross profit and initiate another wave of profit growth.

The milk industry is no exception. Mengniu Dairy, with its strategic positioning of “establishing a market first, then building factories, and relying entirely on grabbing milk sources,” achieved a latecomer advantage in 2007. However, following the tainted milk powder incident, Mengniu fell behind Yili in terms of milk source development and industry chain integration, ultimately relinquishing its leading position to Yili in 2011.

On the other hand, it seems that Ms. Mai from Vinamilk recognized the importance of milk sources early on. Since 1990, Vinamilk has adopted a strategy of achieving self-sufficiency in raw materials, initially through cooperation with dairy farmers: farmers raise the cows themselves, and Vinamilk purchases the milk at a premium price.

However, relying solely on dairy farmers was insufficient to meet the market’s high demand at the time. Starting in 2005, Vinamilk established its own farms, and to this day, it has a total of 14 domestic farms, accounting for 50% of its domestic fresh milk sources and 25% of its overall milk sources (with 25% supplied by dairy farmers and the remaining 50% imported). As Vinamilk purchases milk from farmers at prices higher than those offered by companies in the United States, Australia, and others, the company’s gross profit increases as its farm operations expand.

Furthermore, in 2017, the company acquired a 65% stake in Khanh Hoa Sugar JSC to improve its supply chain and further control raw material costs. This explains why Vinamilk has such a high gross profit margin, which, according to its spokesperson, ranks among the top three in the world.

03 The road to international expansion: Power of quality

It was only in 2010 that Vinamilk began to heavily invest overseas, including establishing farms in Laos and factories in the United States and Cambodia. However, the first step into foreign markets can be traced back to 1997.

At that time, Iraq had a policy of exchanging oil for food, and upon hearing about it, Ms. Mai decided to participate. However, at that time, no one knew about Vietnamese milk powder brands. Vinamilk directly sent two trucks loaded with the milk powder, both to provide nutrition for children in war-torn Iraq and to promote its own brand.

After facing rigorous scrutiny from international partners regarding their products and factories, Vinamilk generated its first international business, a shipment of 300 tons of milk powder in three months. This was a significant deal for Vinamilk at that time: “I didn’t even consider the profit or loss at that time. We agreed and the factory operated 24 hours a day until it was completed,” said Ms. Mai.

In the following years, Vinamilk adopted a bidding model in the Iraqi market, but in 2003, with the change of government, Vinamilk had to start from scratch. However, after this experience, the road to international expansion seemed smoother, and the company became more cautious with each step.

Entering the US market is an example of this. Recognizing the vast consumer base in a country known for its food consumption, Ms. Mai realized that Vinamilk could have a place there. The acquisition and utilization of Driftwood Liquid Milk Plant helped Vinamilk sell its own brand of milk to schools in Northern California and to patriotic Vietnamese residents in the region.

Another example is their venture into organic milk production. With limited resources domestically, Vinamilk decided to purchase land in Laos, covering an area of 5,000 hectares. The reason is that Laos is a neighboring country, and it takes only 6-7 hours to transport the milk back to Vietnam, making it particularly convenient.

To date, Vinamilk’s products have appeared on store shelves in 56 countries and regions, with export revenue accounting for 8% of its total revenue. The United States and Cambodia contribute 5% and 2% of the revenue, respectively, with year-on-year growth rates of 31% and 13% in 2022.

04 The birth of the Dairy King

After nearly 50 years of continuous efforts, Vinamilk has now become the leader in terms of revenue and production in the domestic market, with a market share of approximately 50-55%[2].

Statistics show that at least 9 out of every 10 households in Vietnam use at least one Vinamilk product. In addition to being the second most influential brand in the powdered milk category due to foreign brands, Vinamilk holds the top market position in liquid milk, yogurt, and condensed milk. This is thanks to the company’s highly integrated value chain, which includes milk sources (15 internal and external farms, 6,000 exclusive partner farmers), production and processing facilities (16 domestic and international factories), and distribution channels (traditional: 200 exclusive distributors, 210,000 retail points; modern: 8,000 retail points, 710 chain stores, major e-commerce platforms, etc.).

The company’s market capitalization has reached $7 billion, making it the largest company in the food and beverage industry. The brand value of Vinamilk is also estimated to be as high as $2.8 billion[3].

05 Pioneering in social responsibility and sustainable development

Vinamilk is one of the earliest companies to fulfill its social responsibility, and it excels in various aspects:

Regarding its partnership with dairy farmers, Vinamilk purchases its milk at a high price, about 60 cents per liter. This price is 50-100% higher than the prices in other countries, where milk is sold for only 30-40 cents per liter. Vinamilk sees this as more of a social work, actively contributing to the poverty reduction efforts in response to the government’s policies. This explains why Vinamilk has a stable group of exclusive partner farmers.

For children, Vinamilk established the “Rising Vietnam” Milk Fund in 2008, which has provided 40 million cups of milk to 500,000 children over the past 15 years. The company has also maintained the School Milk Program (with 30% funded by the government, 20% by Vinamilk, and 50% by parents) for 16 years. When questioned why Vinamilk does not provide low-priced milk directly to remote areas and instead opts for a uniform pricing strategy with charitable efforts, Ms. Mai Kieu Lien, Vinamilk’s Executive Director, explained that individual pricing could lead to speculation opportunities, and remote areas naturally incur higher transportation costs, so the uniform pricing already provides subsidies.

In terms of environmental responsibility, the company completed a million-tree planting program in 2020 and established environmentally friendly green farms in 2021. As for the treatment of cow manure, Vinamilk sells the fermented cow manure to farmers for grass and corn cultivation, and the company then purchases the grass and corn from the farmers. This not only promotes environmental sustainability but also benefits both parties economically.

Vinamilk sets a remarkable example in fulfilling its social responsibilities, contributing to the well-being of dairy farmers, children, and the environment, while maintaining its commitment to sustainable development.

06 Where are the new growth opportunities?

In recent years, Vinamilk, which has entered its mature stage, has experienced modest revenue growth ranging from 2% to 7%. In 2022, it even saw a negative growth of 1.6%. Therefore, identifying precise growth points has become the company’s top priority. Currently, the company is pursuing three main directions:

First, develop organic products: Vinamilk already has four organic farms that comply with European standards and three that meet Chinese standards. The pricing of these products is also relatively affordable, at only CNY 45.000 VND per liter (compared to 30.000 VND per liter for regular fresh milk), which is significantly lower than its strong competitor TH True Milk (priced at CNY 60.000 VND per liter). The company firmly believes that the use of organic food is a global trend and aims to meet the increasing demand of ordinary consumers by leveraging its price advantage.

Second, produce and sell beef: According to the Vietnam Livestock Association, 55-60% of beef needs to be imported from abroad, indicating substantial growth potential in the beef market. With its cattle breeding and farming expertise, Vinamilk has decided to collaborate with the Japanese international trading conglomerate Sojitz, with plans to commence official sales in 2024.

Third, continue to develop foreign business: In addition to 100% investments in the United States, Cambodia, and Laos, Vinamilk formed a joint venture with the Philippines’ food and beverage company, Del Monte, holding a 50% stake by the end of 2021. This strategic move aims to leverage Del Monte’s 100,000 retail points to penetrate the Philippine market. The company also plans to build additional factories to control costs if the sales performance is favorable. Furthermore, Vinamilk is also exploring the Indonesian market, a country highly dependent on dairy product imports (with imports accounting for as high as 80% in 2018), although no acquisitions have been planned in the past two years.

It is still too early to draw conclusions. Let’s stay tuned to see how Vinamilk, which has experienced significant ups and downs, will transform under the leadership of Ms. Mai and emerge as a stronger entity.

Reference:

[1] Understanding the past and present of Yili shares in one article (collection), Siyuan Practice, 2023

[2] 2022 Milk Industry Market Share, AC Nielsen, 2023

[3] Food and Beverage Annual Report, Brand Finance, 2022

Kirin Capital is a research-driven equity investment company headquartered in Hanoi, Vietnam. Its core members have more than 20 years of financial experience in China and more than 10 years of financial and industrial investment experience in Vietnam. The investment covers TMT, large consumption, manufacturing, health care and financial services, and other fields, and spans all stages of equity investment such as seed investment, venture capital, private equity investment, listed company investment, and M&A investment.

Our vision is “Know Vietnam, Long Vietnam”. Through rich financial experience and local resources, we will be a guide for investors at home and abroad to invest in Vietnam and share Vietnam’s rapid growth development dividends.

If you have any needs related to the Vietnam market or would like to participate in our Kirin Views program and share your insights into the local market, please feel free to contact us HERE